Ct Uc 2 Form - The connecticut ui number can be found on the employer quarterly contribution return (form conn. Each quarter liable employers in the state of connecticut must file an unemployment insurance. If you are a new employer to connecticut and do not have an employer account number (ean) This number is used as your. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here.

The connecticut ui number can be found on the employer quarterly contribution return (form conn. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. This number is used as your. If you are a new employer to connecticut and do not have an employer account number (ean) Each quarter liable employers in the state of connecticut must file an unemployment insurance.

Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. Each quarter liable employers in the state of connecticut must file an unemployment insurance. This number is used as your. The connecticut ui number can be found on the employer quarterly contribution return (form conn. If you are a new employer to connecticut and do not have an employer account number (ean)

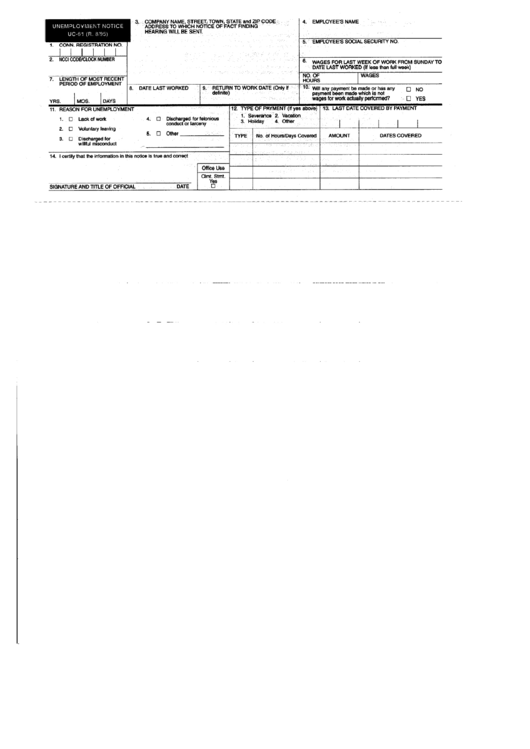

Form Uc61 Unemployment Notice Connecticut Department Of Labor

The connecticut ui number can be found on the employer quarterly contribution return (form conn. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. If you are a new employer to connecticut and do not have an employer account number (ean) This number is used as your. Each quarter liable employers in the state.

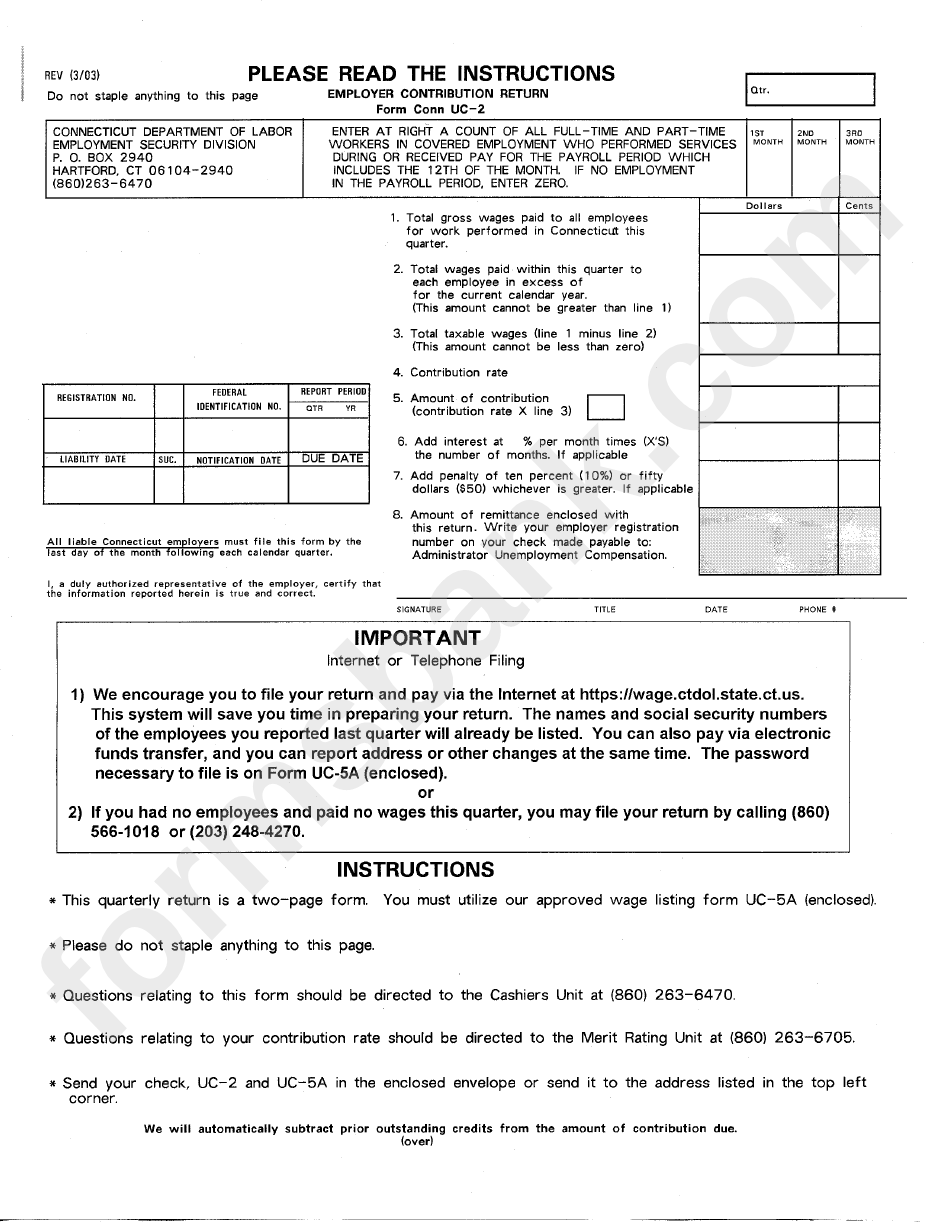

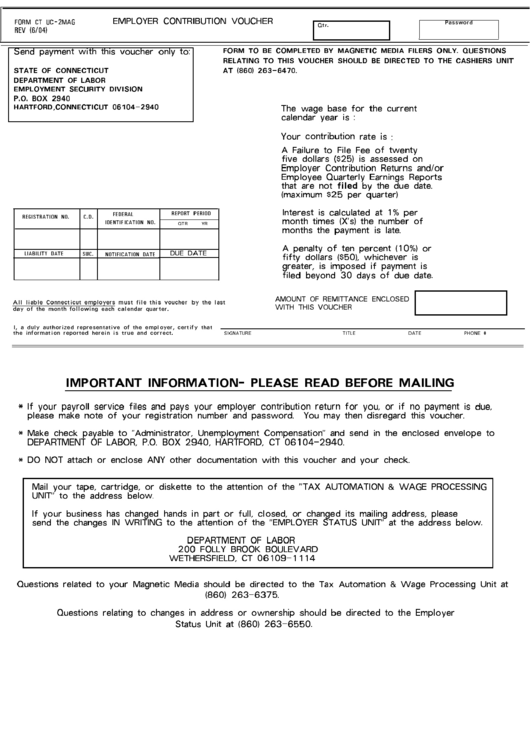

Form Conn Uc2 Employer Contribution Return printable pdf download

The connecticut ui number can be found on the employer quarterly contribution return (form conn. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. This number is used as your. Each quarter liable employers in the state of connecticut must file an unemployment insurance. If you are a new employer to connecticut and do.

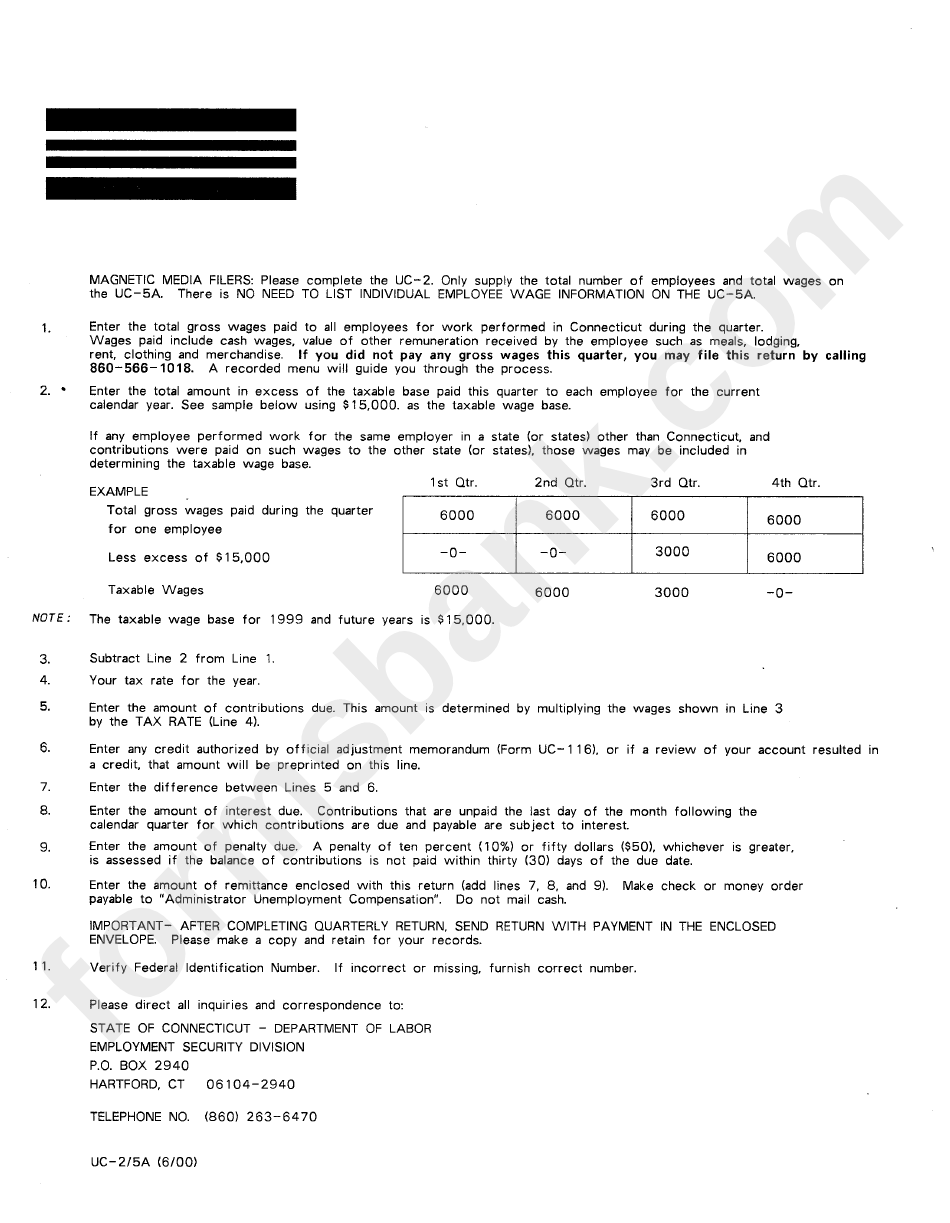

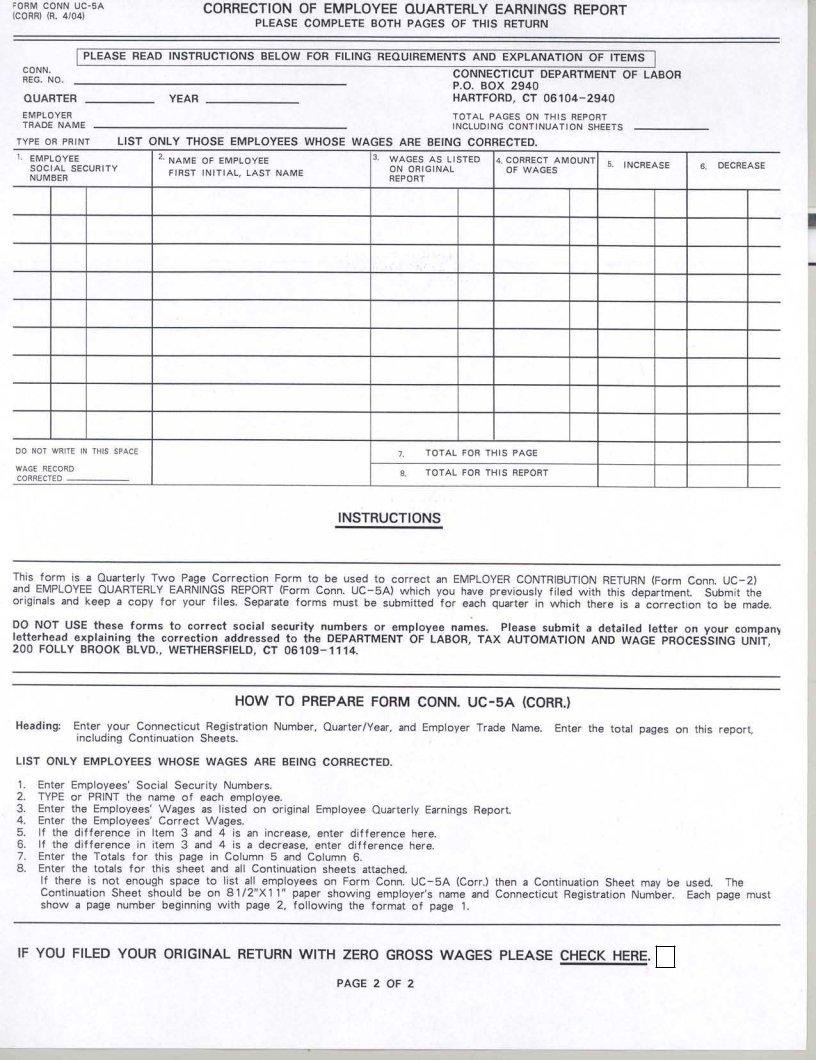

Form Uc2/5a Instructions printable pdf download

If you are a new employer to connecticut and do not have an employer account number (ean) The connecticut ui number can be found on the employer quarterly contribution return (form conn. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. This number is used as your. Each quarter liable employers in the state.

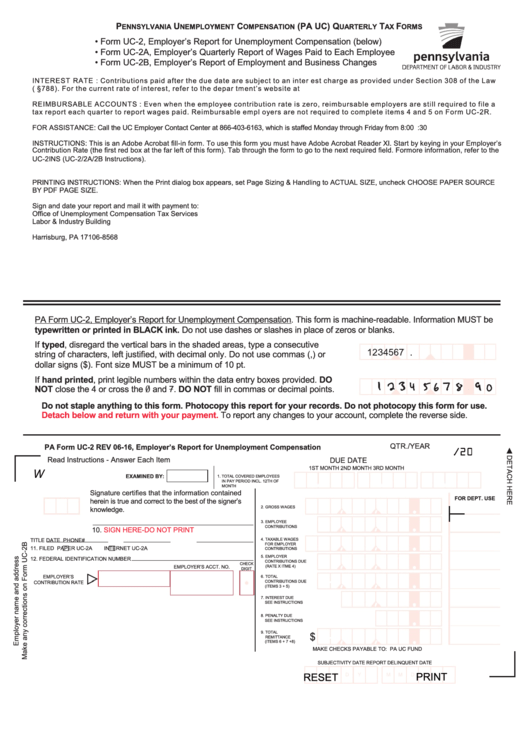

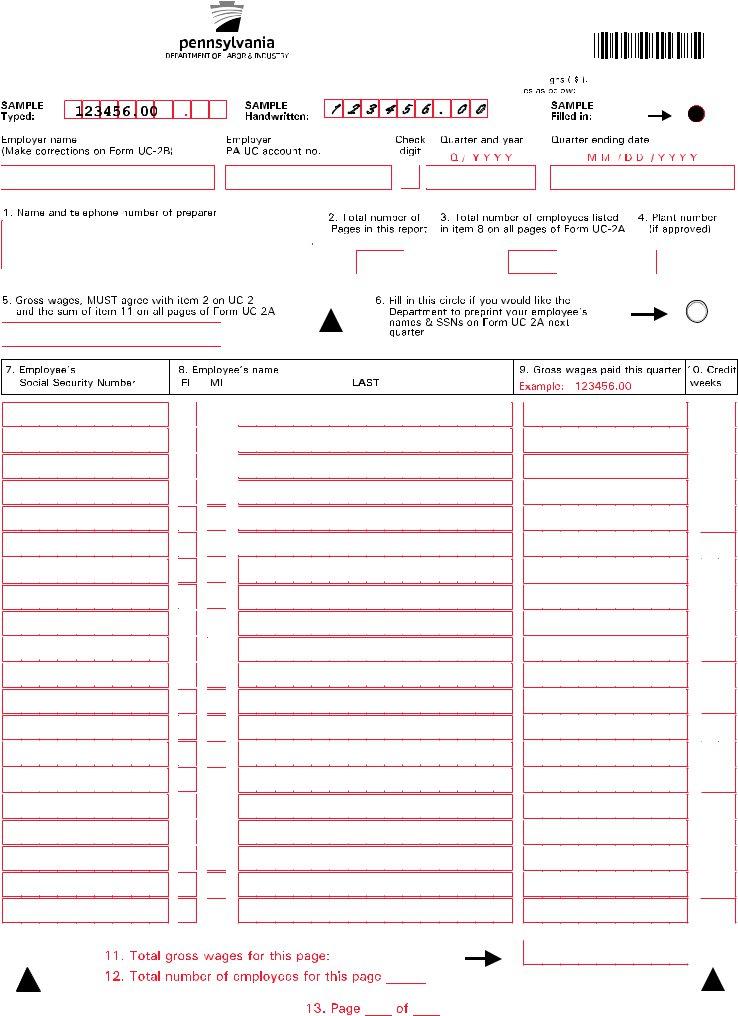

Fillable Form Uc2 Employer'S Report For Unemployment Compensation

Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. The connecticut ui number can be found on the employer quarterly contribution return (form conn. This number is used as your. Each quarter liable employers in the state of connecticut must file an unemployment insurance. If you are a new employer to connecticut and do.

Uc 2A Form ≡ Fill Out Printable PDF Forms Online

Each quarter liable employers in the state of connecticut must file an unemployment insurance. If you are a new employer to connecticut and do not have an employer account number (ean) Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. This number is used as your. The connecticut ui number can be found on.

Fillable Form Ct Uc2mag Employer Contribution Voucher printable pdf

If you are a new employer to connecticut and do not have an employer account number (ean) The connecticut ui number can be found on the employer quarterly contribution return (form conn. Each quarter liable employers in the state of connecticut must file an unemployment insurance. This number is used as your. Connecticut employers can file unemployment taxes, get necessary.

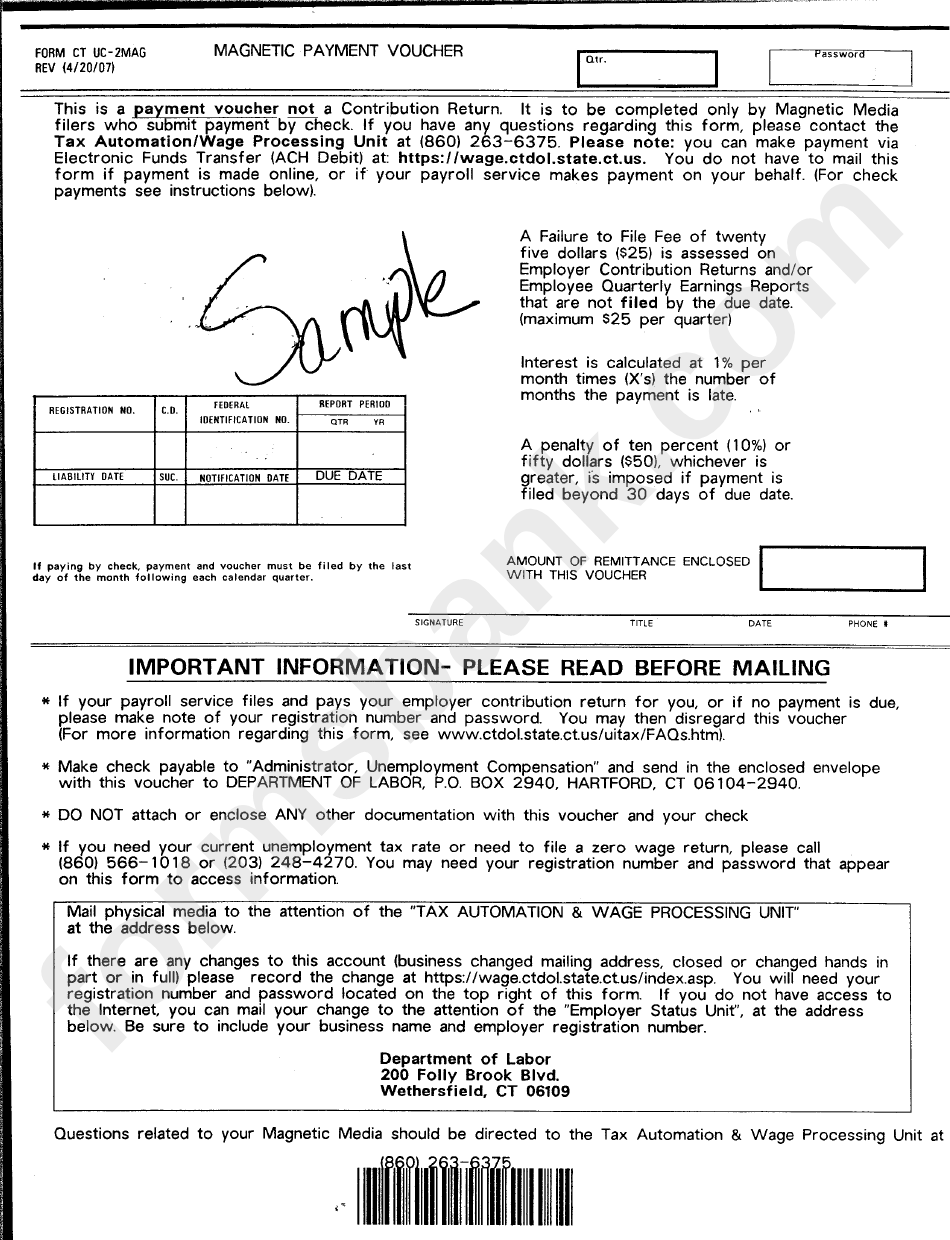

Form Ct Uc2mag Sample Payment Voucher Department Of Labor

If you are a new employer to connecticut and do not have an employer account number (ean) The connecticut ui number can be found on the employer quarterly contribution return (form conn. This number is used as your. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. Each quarter liable employers in the state.

Uc 2 Form Connecticut ≡ Fill Out Printable PDF Forms Online

The connecticut ui number can be found on the employer quarterly contribution return (form conn. This number is used as your. If you are a new employer to connecticut and do not have an employer account number (ean) Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. Each quarter liable employers in the state.

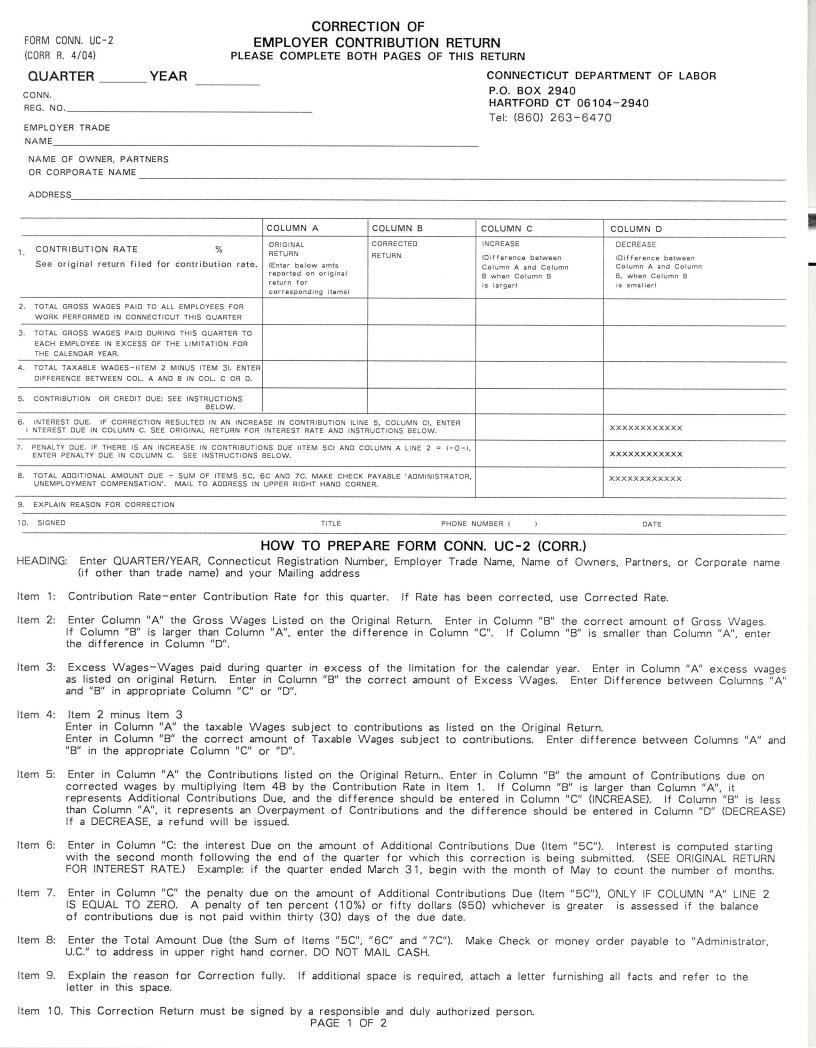

Connecticut Uc 2 Form ≡ Fill Out Printable PDF Forms Online

The connecticut ui number can be found on the employer quarterly contribution return (form conn. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. Each quarter liable employers in the state of connecticut must file an unemployment insurance. If you are a new employer to connecticut and do not have an employer account number.

Printable Ct Uc 2 Form Printable Forms Free Online

Each quarter liable employers in the state of connecticut must file an unemployment insurance. Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. The connecticut ui number can be found on the employer quarterly contribution return (form conn. If you are a new employer to connecticut and do not have an employer account number.

This Number Is Used As Your.

Connecticut employers can file unemployment taxes, get necessary forms, and understand benefit payment procedures here. If you are a new employer to connecticut and do not have an employer account number (ean) The connecticut ui number can be found on the employer quarterly contribution return (form conn. Each quarter liable employers in the state of connecticut must file an unemployment insurance.