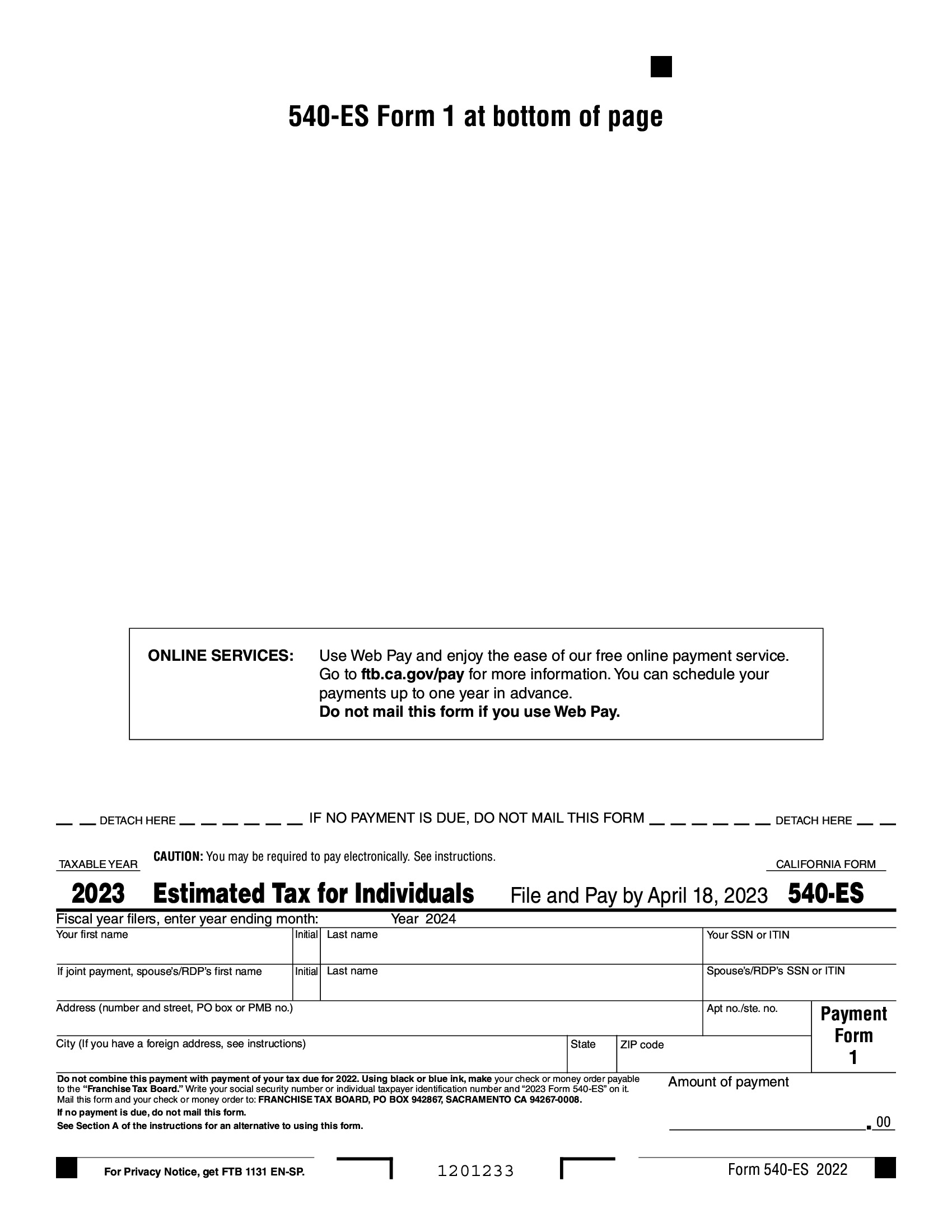

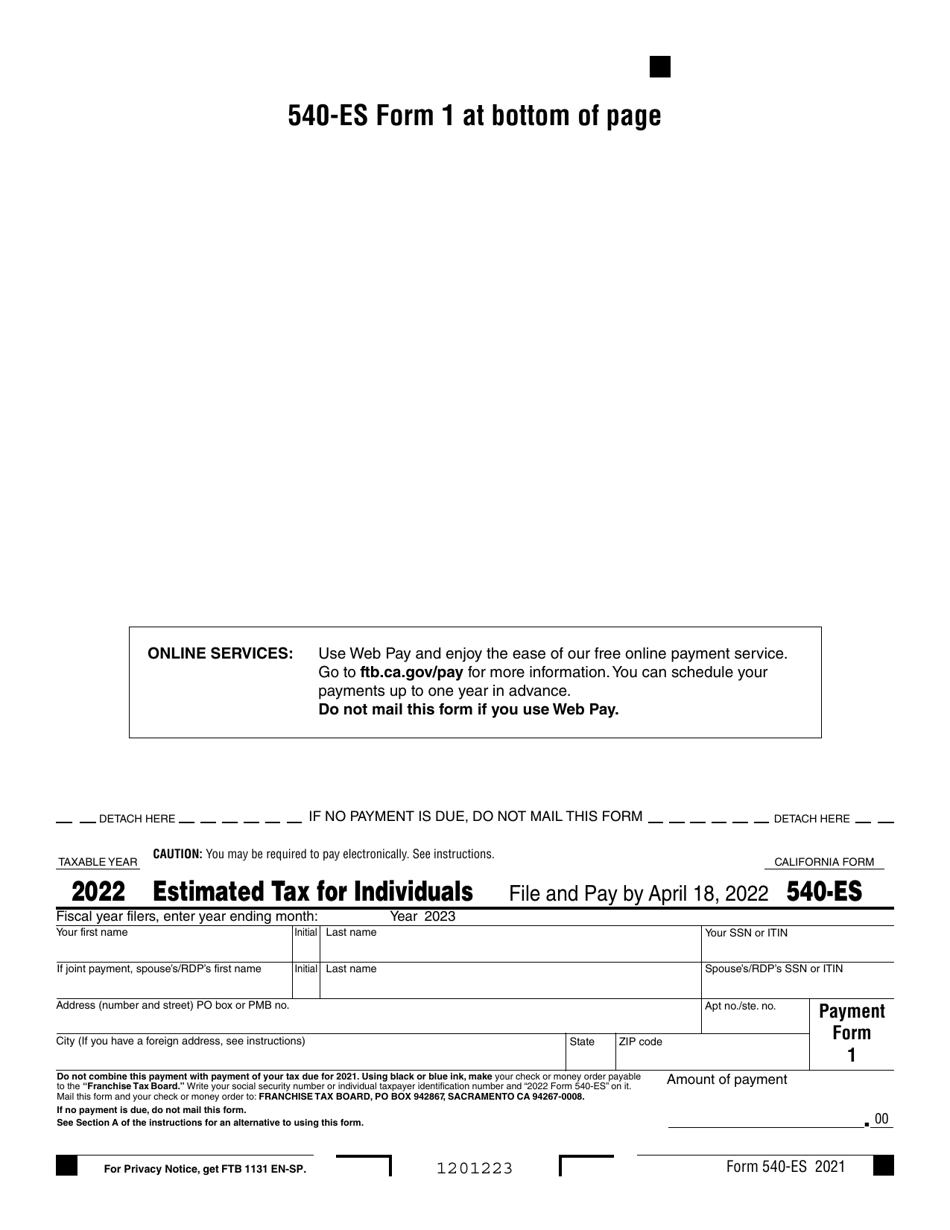

California State Estimated Tax Form - You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Fiscal year filers, enter year ending month: 2023 s corporation income tax returns due and tax due (for calendar year. 2023 fourth quarter estimated tax payments due for individuals. Estimated tax is used to.

2023 s corporation income tax returns due and tax due (for calendar year. 2023 fourth quarter estimated tax payments due for individuals. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Fiscal year filers, enter year ending month:

Estimated tax is used to. Fiscal year filers, enter year ending month: 2023 s corporation income tax returns due and tax due (for calendar year. 2023 fourth quarter estimated tax payments due for individuals. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Ca Estimated Tax 2024 Leda Sharyl

2023 fourth quarter estimated tax payments due for individuals. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Fiscal year filers, enter year ending month: 2023 s corporation income tax returns due and tax due (for calendar year.

California Estimated Tax Worksheet 2024

Estimated tax is used to. 2023 fourth quarter estimated tax payments due for individuals. Fiscal year filers, enter year ending month: 2023 s corporation income tax returns due and tax due (for calendar year. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Nys Estimated Tax Payments 2024 Online Dorey

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Fiscal year filers, enter year ending month: 2023 fourth quarter estimated tax payments due for individuals. 2023 s corporation income tax returns due and tax due (for calendar year.

2024 California Estimated Tax Payments Seka Winona

2023 s corporation income tax returns due and tax due (for calendar year. Estimated tax is used to. 2023 fourth quarter estimated tax payments due for individuals. Fiscal year filers, enter year ending month: You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

California Form 540 Es 2023 Printable Forms Free Online

2023 fourth quarter estimated tax payments due for individuals. Estimated tax is used to. 2023 s corporation income tax returns due and tax due (for calendar year. Fiscal year filers, enter year ending month: You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Ca State Estimated Tax Form 2024 Barb Marice

Fiscal year filers, enter year ending month: 2023 fourth quarter estimated tax payments due for individuals. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. 2023 s corporation income tax returns due and tax due (for calendar year. Estimated tax is used to.

2024 California Estimated Tax Worksheet

2023 fourth quarter estimated tax payments due for individuals. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. 2023 s corporation income tax returns due and tax due (for calendar year. Fiscal year filers, enter year ending month:

California State Estimated Tax Payments 2024 Betta Donielle

Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Fiscal year filers, enter year ending month: 2023 fourth quarter estimated tax payments due for individuals. 2023 s corporation income tax returns due and tax due (for calendar year.

California State Tax Return Deadline 2024 Berny Kissie

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Fiscal year filers, enter year ending month: 2023 s corporation income tax returns due and tax due (for calendar year. Estimated tax is used to. 2023 fourth quarter estimated tax payments due for individuals.

State Of Maryland Estimated Tax Payments 2024 ashly lizbeth

2023 s corporation income tax returns due and tax due (for calendar year. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. 2023 fourth quarter estimated tax payments due for individuals. Fiscal year filers, enter year ending month:

2023 Fourth Quarter Estimated Tax Payments Due For Individuals.

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. 2023 s corporation income tax returns due and tax due (for calendar year. Fiscal year filers, enter year ending month: Estimated tax is used to.