Az Extension Form - Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. An arizona extension for a partnership or s corporation cannot be granted for more than six months beyond the original due date of the. Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Arizona will accept a valid federal calendar year filer, your request for a 2023 filing extension extension for the period covered by the federal. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty.

File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. An arizona extension for a partnership or s corporation cannot be granted for more than six months beyond the original due date of the. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Arizona will accept a valid federal calendar year filer, your request for a 2023 filing extension extension for the period covered by the federal. Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty.

An arizona extension for a partnership or s corporation cannot be granted for more than six months beyond the original due date of the. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Arizona will accept a valid federal calendar year filer, your request for a 2023 filing extension extension for the period covered by the federal.

Hair Extension Client Contract Attorneywritten Editable Instant

Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. An arizona extension for a partnership or s corporation cannot be granted for more than six months beyond the original due date of the. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t,.

Editable Hair Extension Form Templates, Hair Salon Canva Templates

File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Arizona will accept a valid federal calendar year filer, your request for a 2023 filing extension extension for the period covered by the federal. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et,.

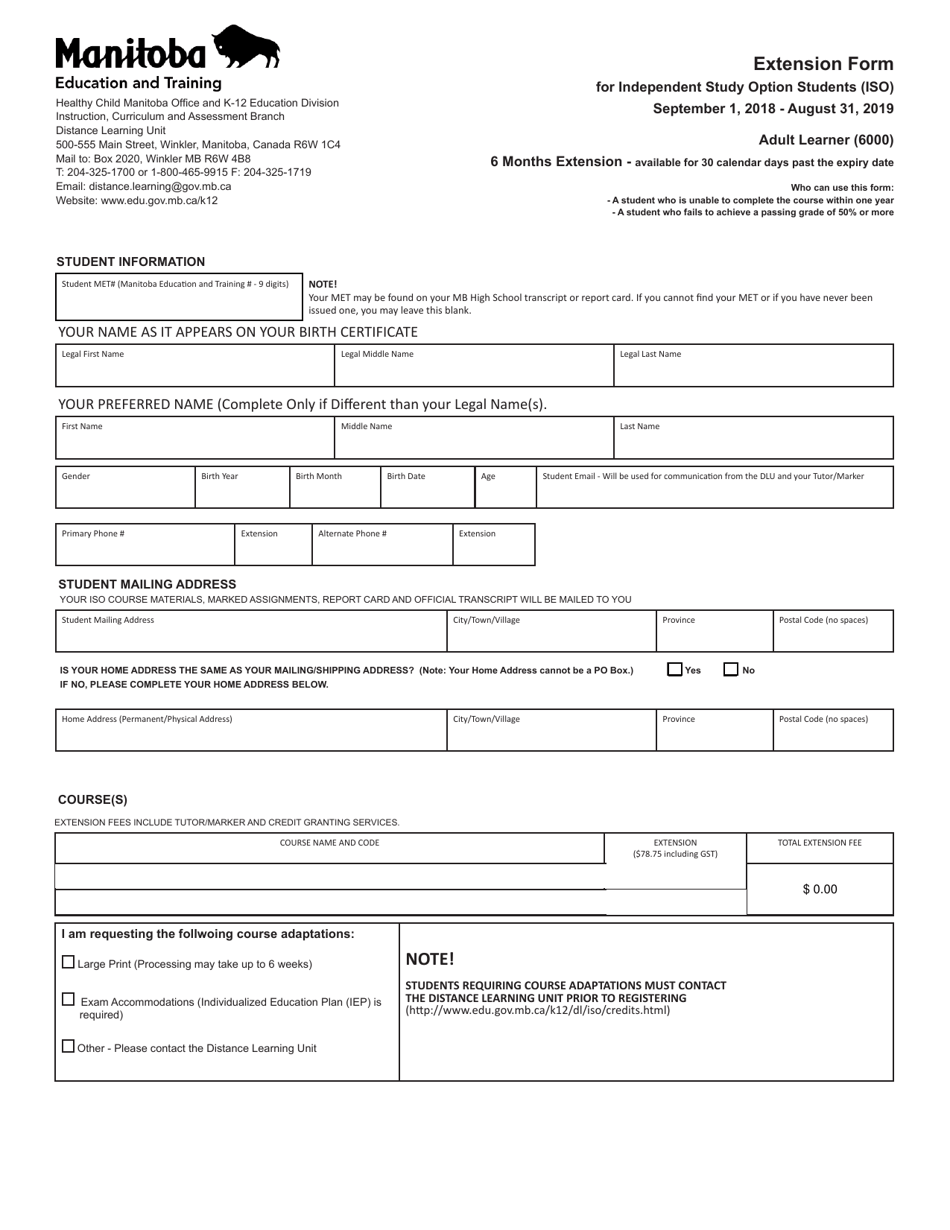

2019 Manitoba Canada Extension Form for Independent Study Option

File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. An arizona extension for a partnership or s corporation cannot be granted for more than six months beyond the original due date of the. Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. Arizona.

PaperClip

Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. An arizona extension for a partnership or s corporation cannot be granted for more than six months beyond the original due date of the. Get the tax forms, know where to send them, and understand the process for arizona.

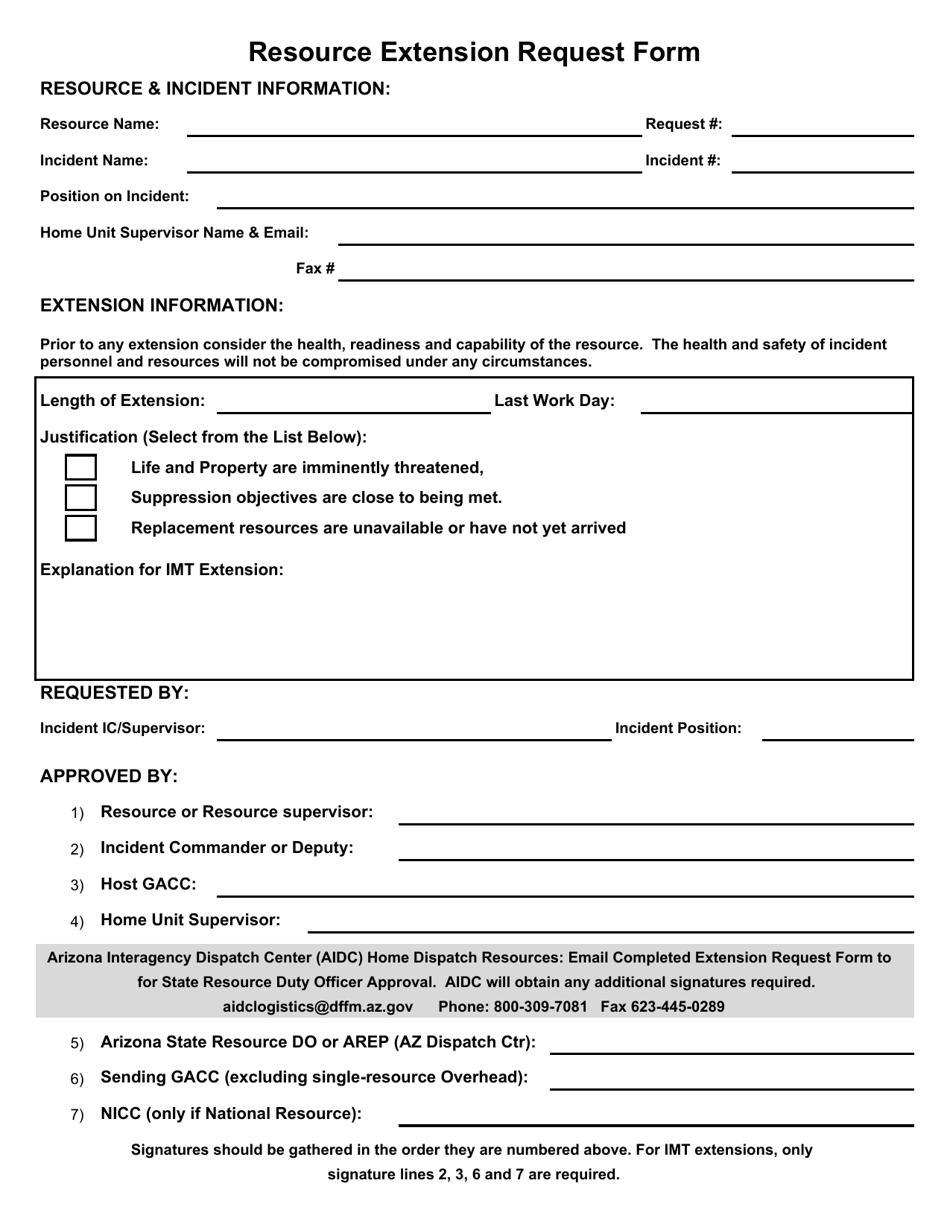

Arizona Resource Extension Request Form Download Printable PDF

Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension.

Fiidom Extension for Google Chrome Extension Download

Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or.

What is CA extension Form 3539? YouTube

Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Taxpayers must.

Az A4 2023 Form Printable Forms Free Online

Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py,.

Residential Lease Extension Agreement Form Printable Form, Templates

Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment.

Free Fillable Residential Lease Extension Form Printable Forms Free

Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Arizona will accept a valid federal calendar year filer, your request for a 2023 filing extension.

An Arizona Extension For A Partnership Or S Corporation Cannot Be Granted For More Than Six Months Beyond The Original Due Date Of The.

Arizona will accept a valid federal calendar year filer, your request for a 2023 filing extension extension for the period covered by the federal. Taxpayers must pay at least 90% of the current year tax liability by april 15 to avoid an extension underpayment penalty. Get the tax forms, know where to send them, and understand the process for arizona personal tax extensions. File this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165.