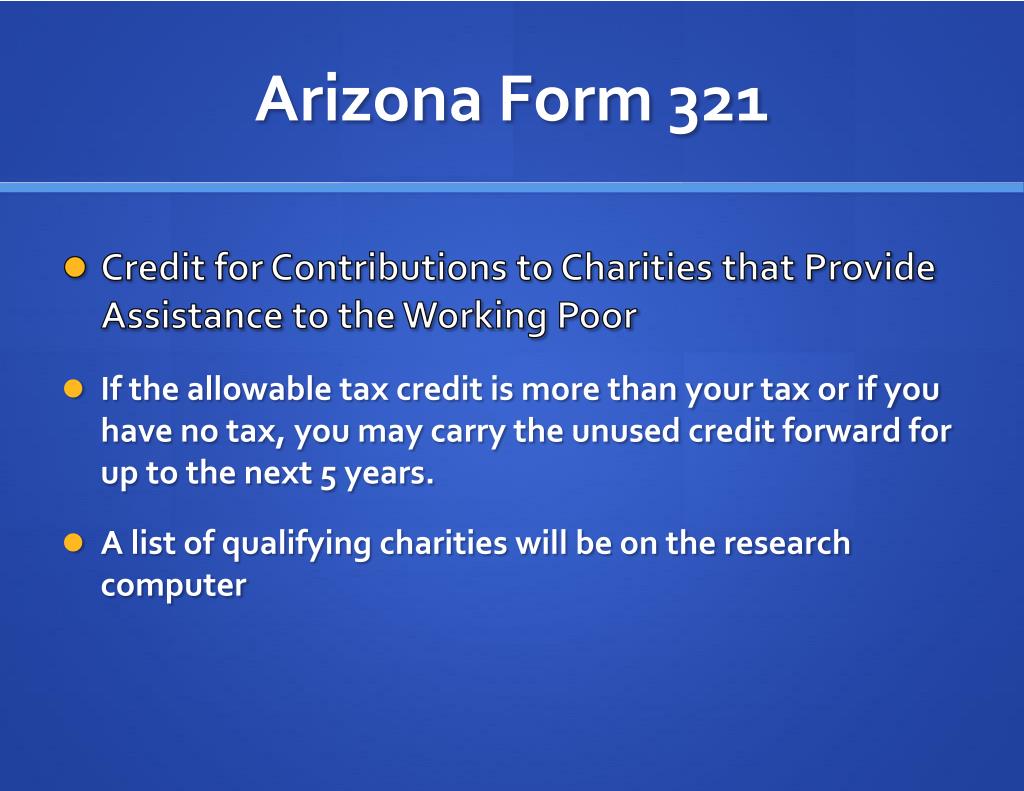

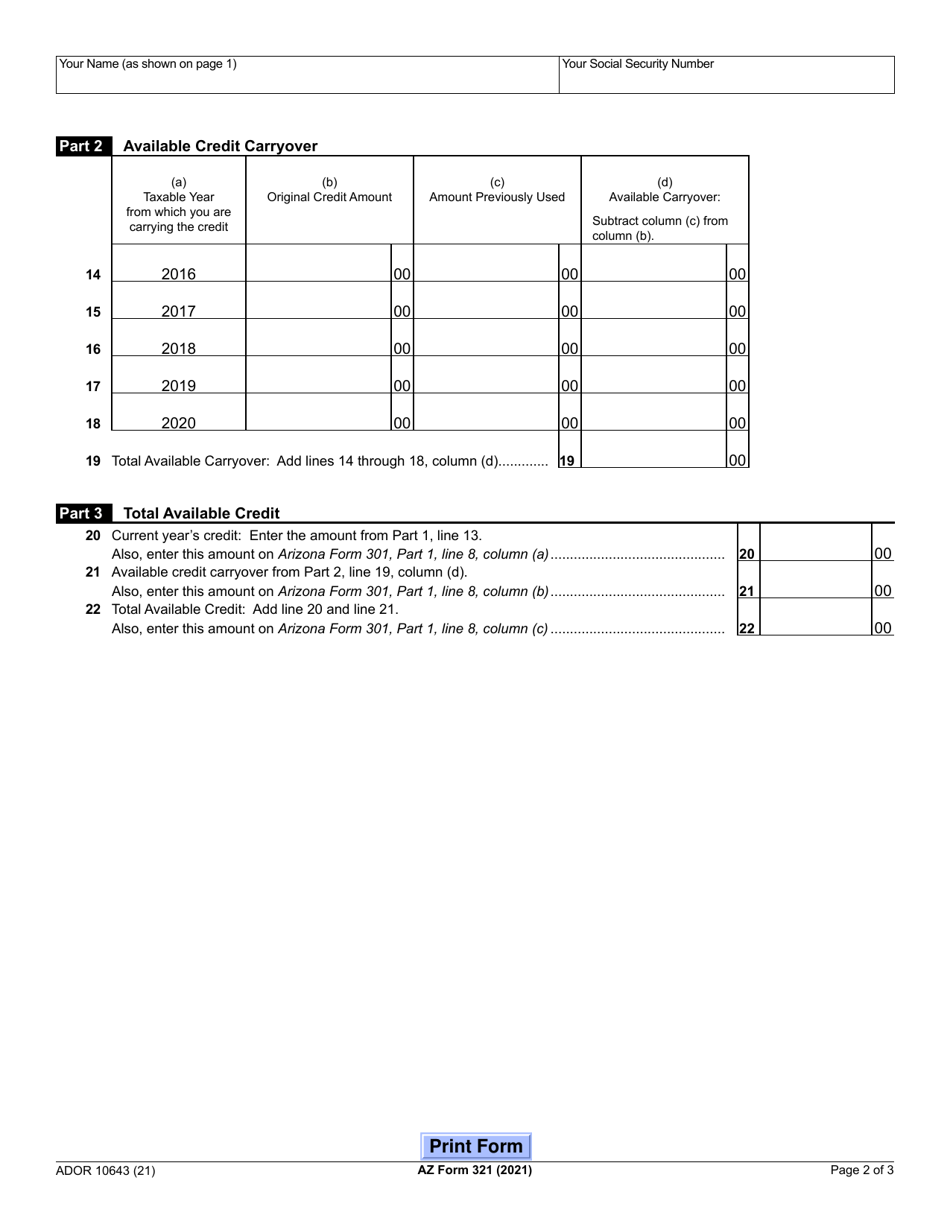

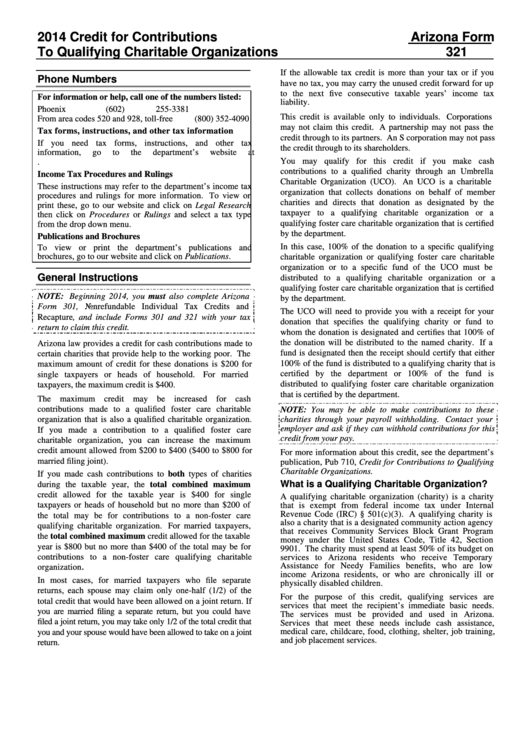

Arizona Tax Form 321 - To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. Credit for contributions to charities that provide assistance to the. The maximum qco credit donation amount for. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. Arizona department of revenue subject:

Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. The maximum qco credit donation amount for. Credit for contributions to charities that provide assistance to the. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Az form 321 credit for contributions to qualifying charitable organizations. Arizona department of revenue subject:

13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Arizona department of revenue subject: To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. Az form 321 credit for contributions to qualifying charitable organizations. Credit for contributions to charities that provide assistance to the. Credit for contributions to charities that provide assistance to the. The maximum qco credit donation amount for. Arizona department of revenue subject: If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five.

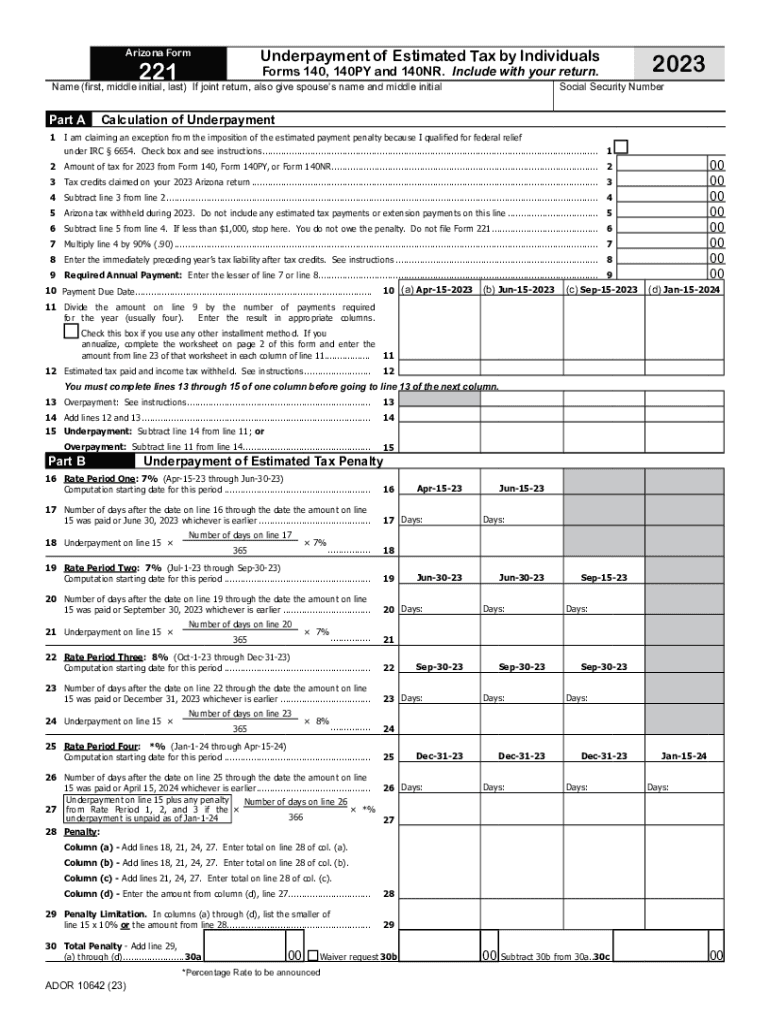

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

Credit for contributions to charities that provide assistance to the. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. The maximum qco credit donation amount for. Arizona department of revenue subject: Credit for contributions to charities that provide assistance to.

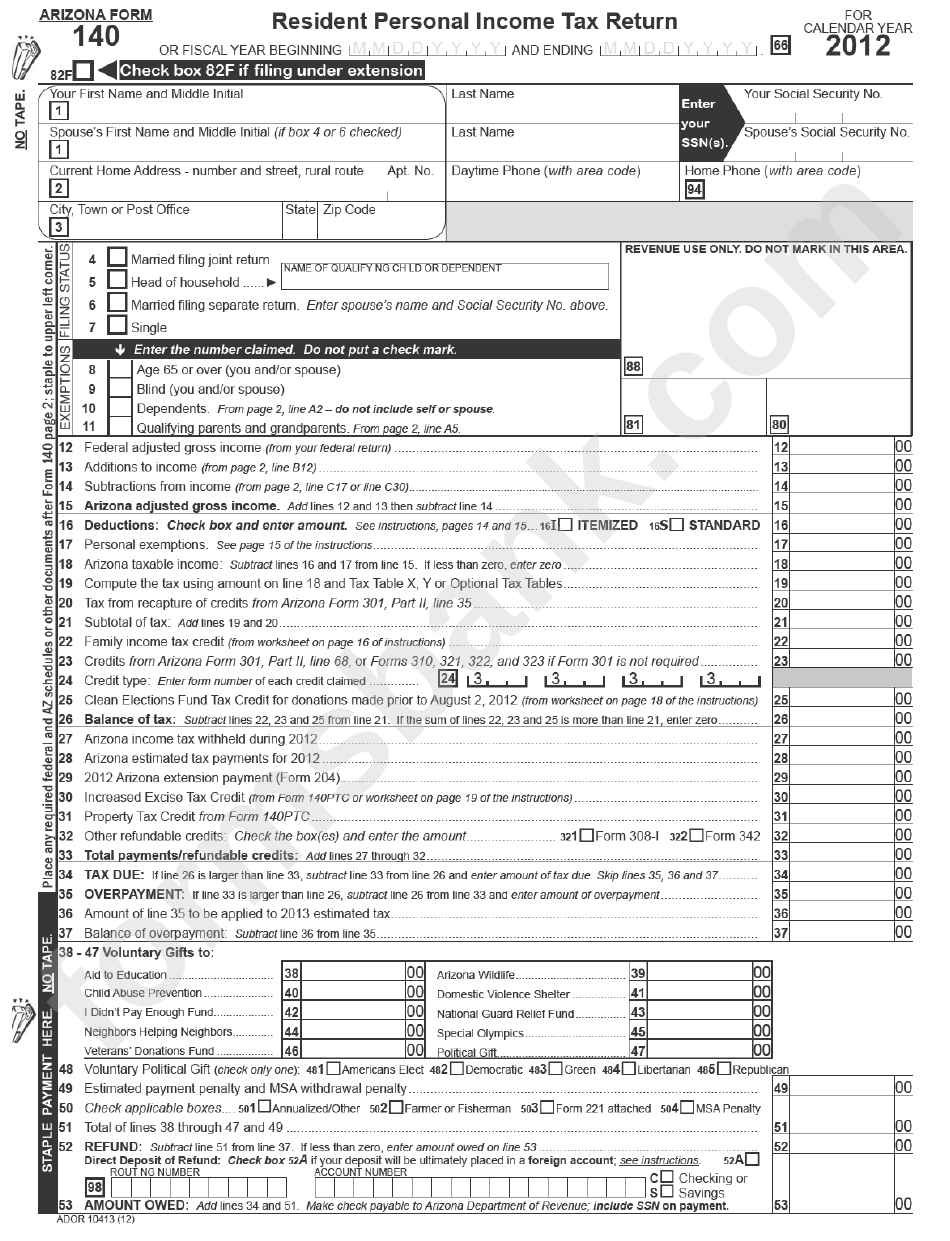

Arizona Tax Form 2024 Wilie Julianna

Arizona department of revenue subject: Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the.

2022 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

Credit for contributions to charities that provide assistance to the. Az form 321 credit for contributions to qualifying charitable organizations. Credit for contributions to charities that provide assistance to the. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Arizona department of revenue subject:

Arizona Charitable Tax Credit AZ Form 321 Fill Out and Sign Printable

Arizona department of revenue subject: Credit for contributions to charities that provide assistance to the. The maximum qco credit donation amount for. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include.

Arizona Fillable Tax Form 140a Printable Forms Free Online

The maximum qco credit donation amount for. 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. Az form 321 credit for contributions to qualifying charitable organizations. Arizona department.

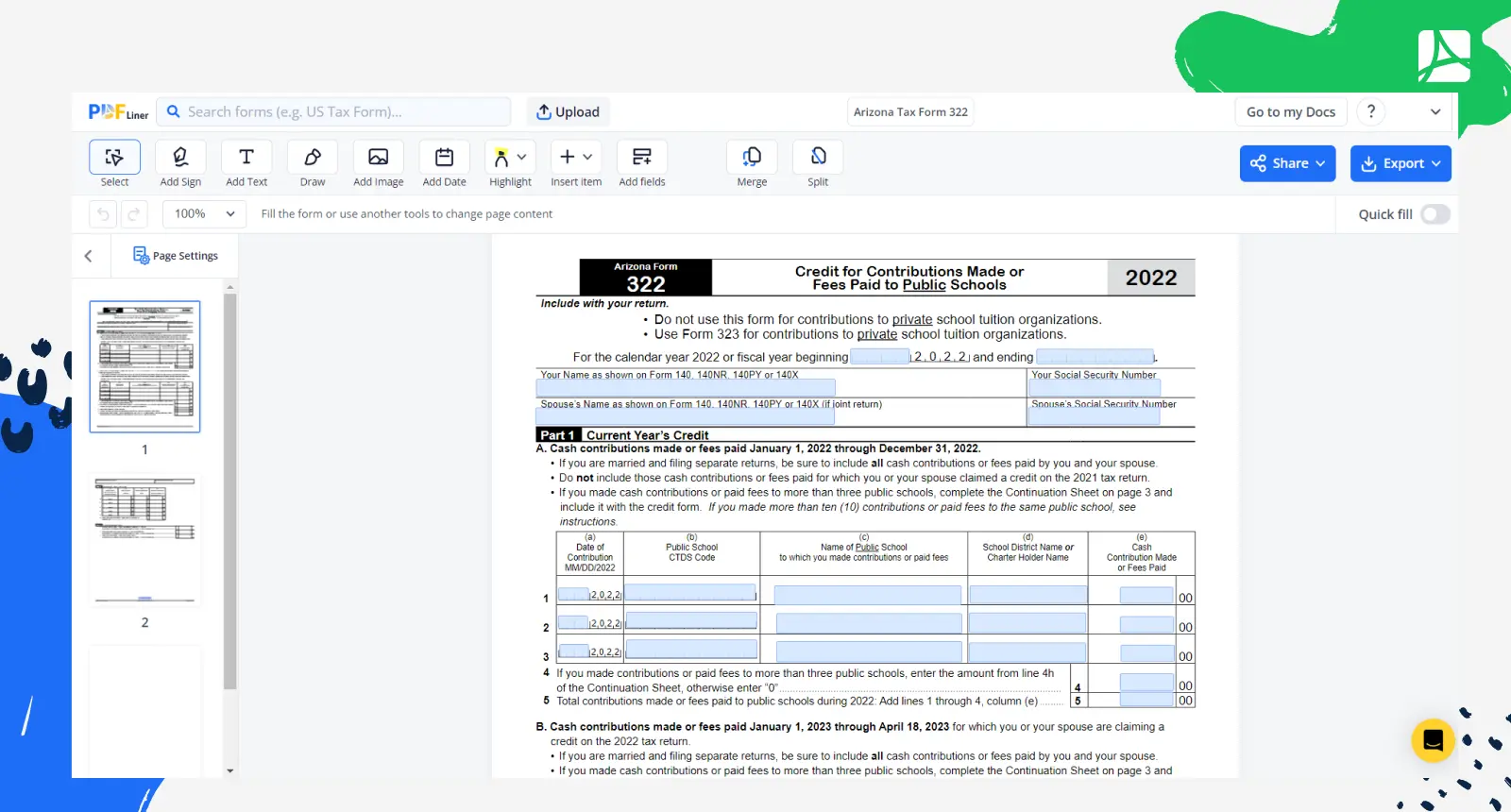

Printable Arizona Tax Form 322 blank, sign forms online — PDFliner

To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your. Arizona department of revenue subject: 13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the. Arizona department of revenue.

Arizona Form 321 (ADOR10643) 2021 Fill Out, Sign Online and

Arizona department of revenue subject: The maximum qco credit donation amount for. Az form 321 credit for contributions to qualifying charitable organizations. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Credit for contributions to charities that provide assistance to.

Instructions For Form 321 Credit For Contributions To Qualifying

Credit for contributions to charities that provide assistance to the. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include.

Arizona form 321 qualifying Fill out & sign online DocHub

Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: Arizona department of revenue subject: If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. To claim your arizona charitable tax credit after donating to an.

Arizona Tax Credit Alert 2019 BeachFleischman CPAs

13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the. If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Credit for contributions to.

Arizona Department Of Revenue Subject:

If the allowable tax credit is more than your tax or if you have no tax, you may carry the unused credit forward for up to the next five. Credit for contributions to charities that provide assistance to the. Arizona department of revenue subject: Az form 321 credit for contributions to qualifying charitable organizations.

The Maximum Qco Credit Donation Amount For.

13 rows a nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (qco). Credit for contributions to charities that provide assistance to the. To claim your arizona charitable tax credit after donating to an eligible charitable organization, fill out arizona form 321 and include it with your.