American Opportunity Credit Form - Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. How much can i claim with the american opportunity credit? Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. The american opportunity credit offers significant savings.

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. The american opportunity credit offers significant savings. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. How much can i claim with the american opportunity credit? Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education.

Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. How much can i claim with the american opportunity credit? The american opportunity credit offers significant savings.

American Opportunity Tax Credit, Eligibility, Refundable, Calculator

The american opportunity credit offers significant savings. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit.

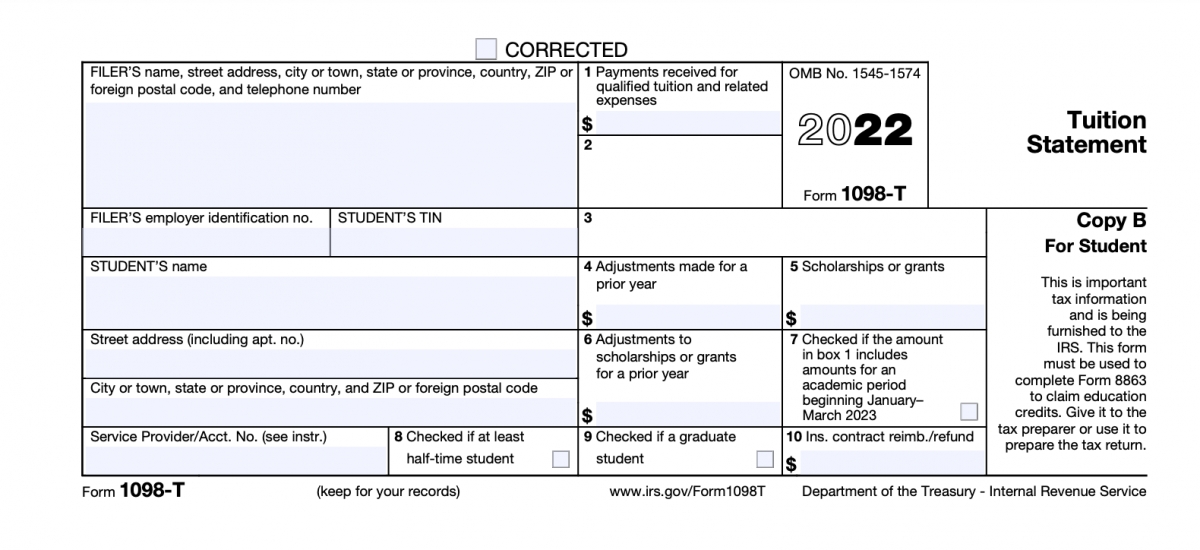

Education Tax Credits (1098T) Old Dominion University

Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit.

The Lifetime Learning Credit Key Factors

The american opportunity credit offers significant savings. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Complete part iii for each student for whom you’re claiming either.

American Opportunity Tax Credit Calculator Internal Revenue Code

Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your.

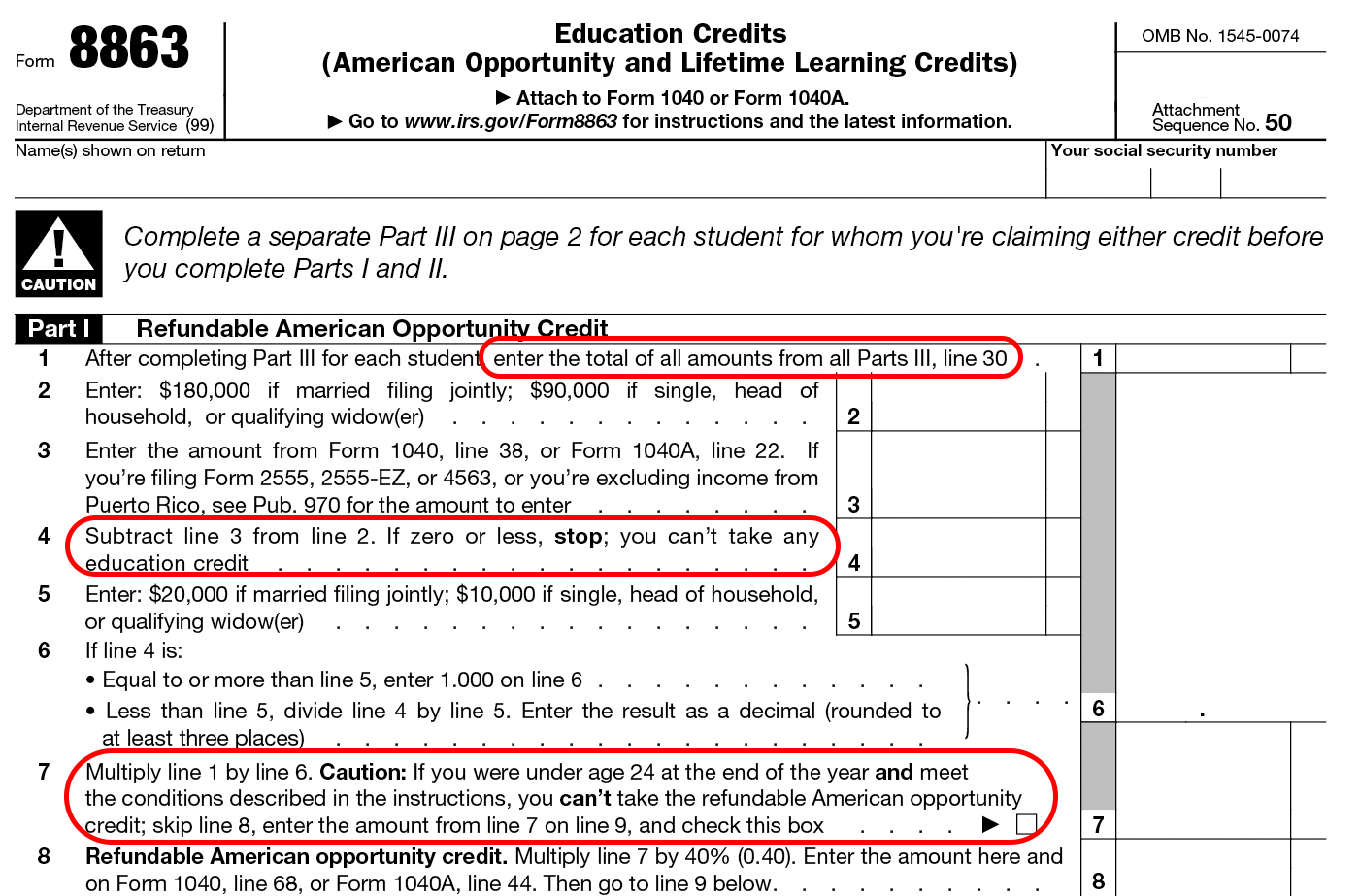

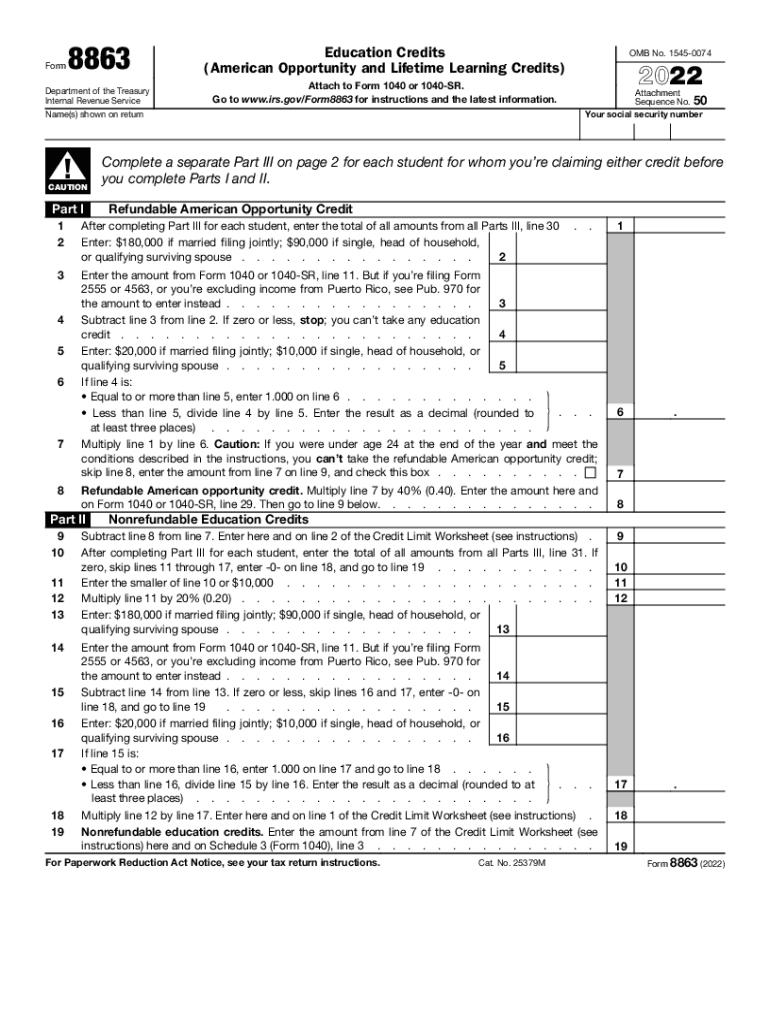

How to File Form 8863 for American Opportunity Tax Credit for 2022

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. The american opportunity credit offers significant savings. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete part iii for each student for whom you’re claiming either.

Printable Form 8863

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. The american opportunity credit offers significant savings. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete part iii for each student for whom you’re claiming either.

2022 Form IRS 8863 Fill Online, Printable, Fillable, Blank pdfFiller

The american opportunity credit offers significant savings. How much can i claim with the american opportunity credit? Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the.

American Opportunity Credit 2024

The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. How much can i claim with the american opportunity credit? Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use.

Can you only claim the AOTC once? Leia aqui How many times can I claim

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. The american opportunity credit offers significant savings. How much can i claim with the american opportunity credit? Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete.

American Opportunity Credit Complete with ease airSlate SignNow

Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your.

How Much Can I Claim With The American Opportunity Credit?

Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit.