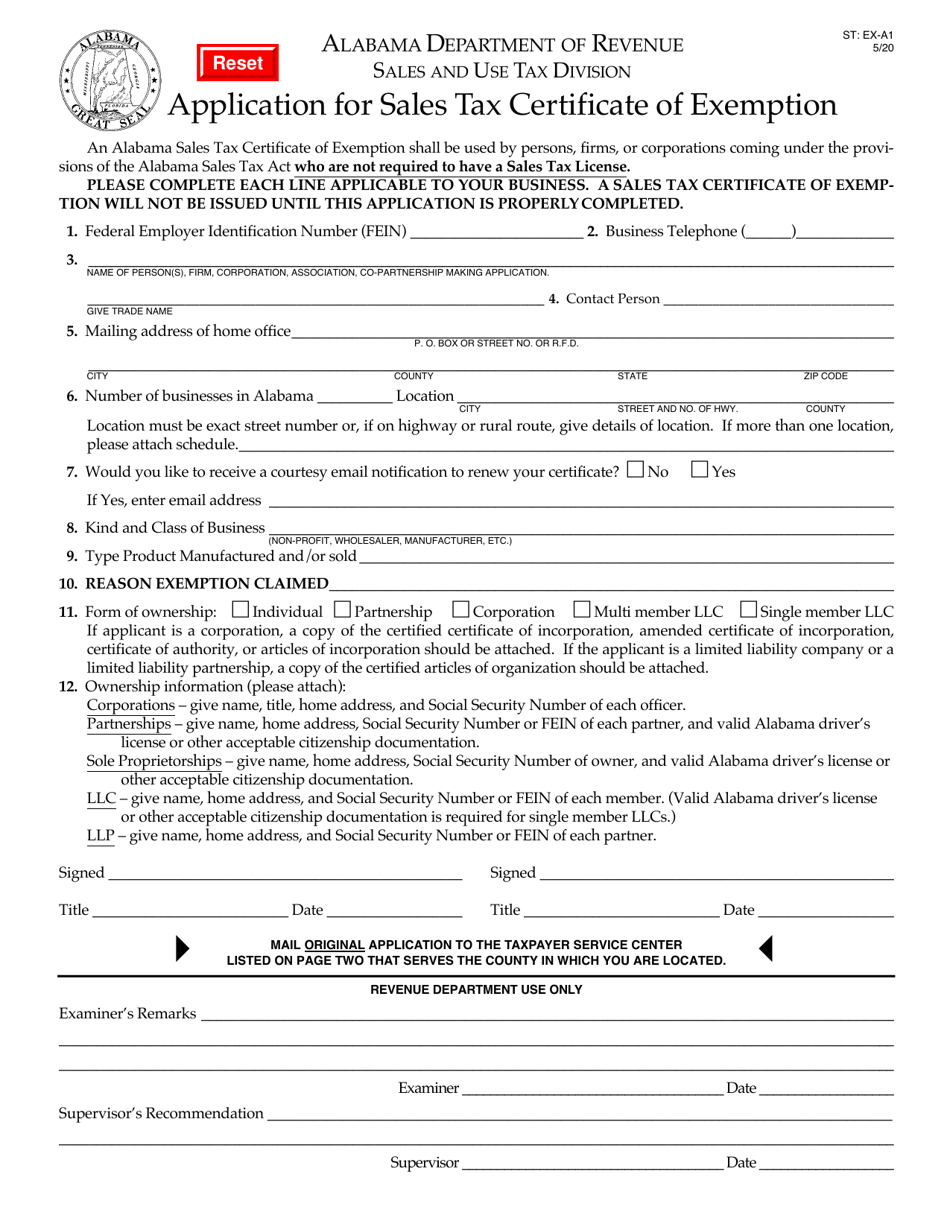

Alabama State Tax Exemption Form - If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption. This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation.

This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption. While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation.

While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption.

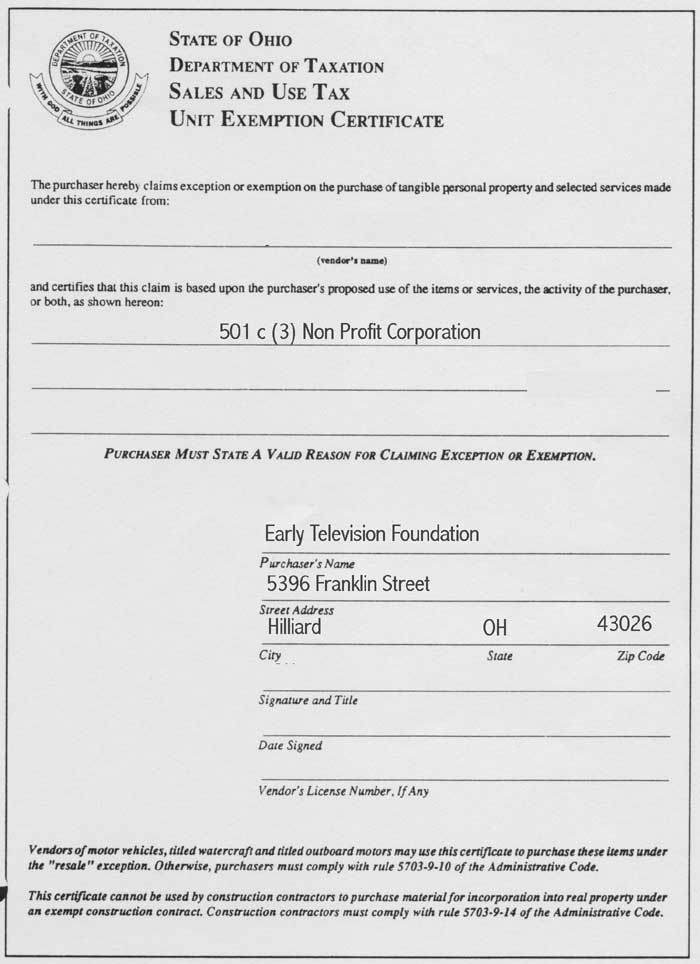

Mi State Tax Exemption Form

This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. If a cnu tax account is not already open under the.

W4 Form Instructions Follow these Steps to Complete W4

This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. If a cnu tax account is not already open under the.

Sd Certificate Of Exemption For Sales Tax

While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form is for persons, firms, or corporations who are not required to have a.

Alabama Form A4 Employee's Withholding Tax Exemption Certificate 2024

While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. If a cnu tax account is not already open under the taxpayer/business name, one will.

Florida State Sales Tax Exemption Form Example

If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption. While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. This form is for persons, firms, or corporations who are not required to have a sales.

Form ST EXA1 Download Fillable PDF or Fill Online Application for

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. While the alabama sales tax of 4% applies to most transactions,.

Mississippi Sales And Use Tax Exemption Form

If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption. This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. A sales tax exemption certificate can be used by businesses (or in.

State Of Alabama Tax Exempt Form

This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption. While the alabama sales tax of 4% applies to most transactions, there.

Seniors and Veterans Get Your Property Tax Cut Iowans for Tax Relief

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. If a cnu tax account is not already open under the taxpayer/business name, one will.

Homestead related tax exemptions Fill out & sign online DocHub

While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama. If a cnu tax account is not already open under the taxpayer/business name, one.

A Sales Tax Exemption Certificate Can Be Used By Businesses (Or In Some Cases, Individuals) Who Are Making Purchases That Are Exempt From The.

If a cnu tax account is not already open under the taxpayer/business name, one will automatically be assigned at the time the exemption. While the alabama sales tax of 4% applies to most transactions, there are certain items that may be exempt from taxation. This form is for persons, firms, or corporations who are not required to have a sales tax license and claim an exemption under the alabama.