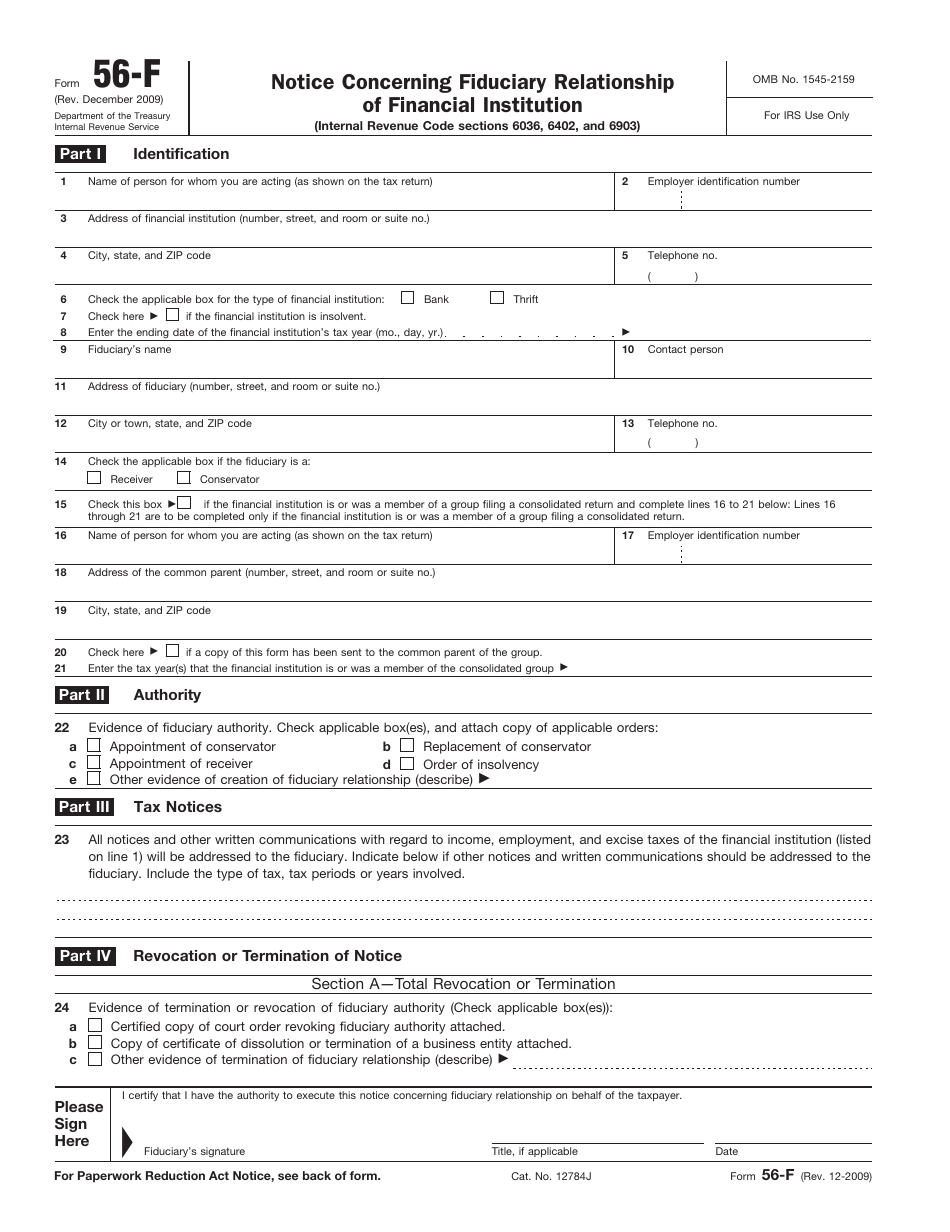

56 F Form - The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. The form must also be filed in every subsequent tax year that the.

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

IRS Form 56F Fill Out, Sign Online and Download Fillable PDF

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a.

BSF Constable Tradesmen Recruitment Online Form 2023, Short

The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a.

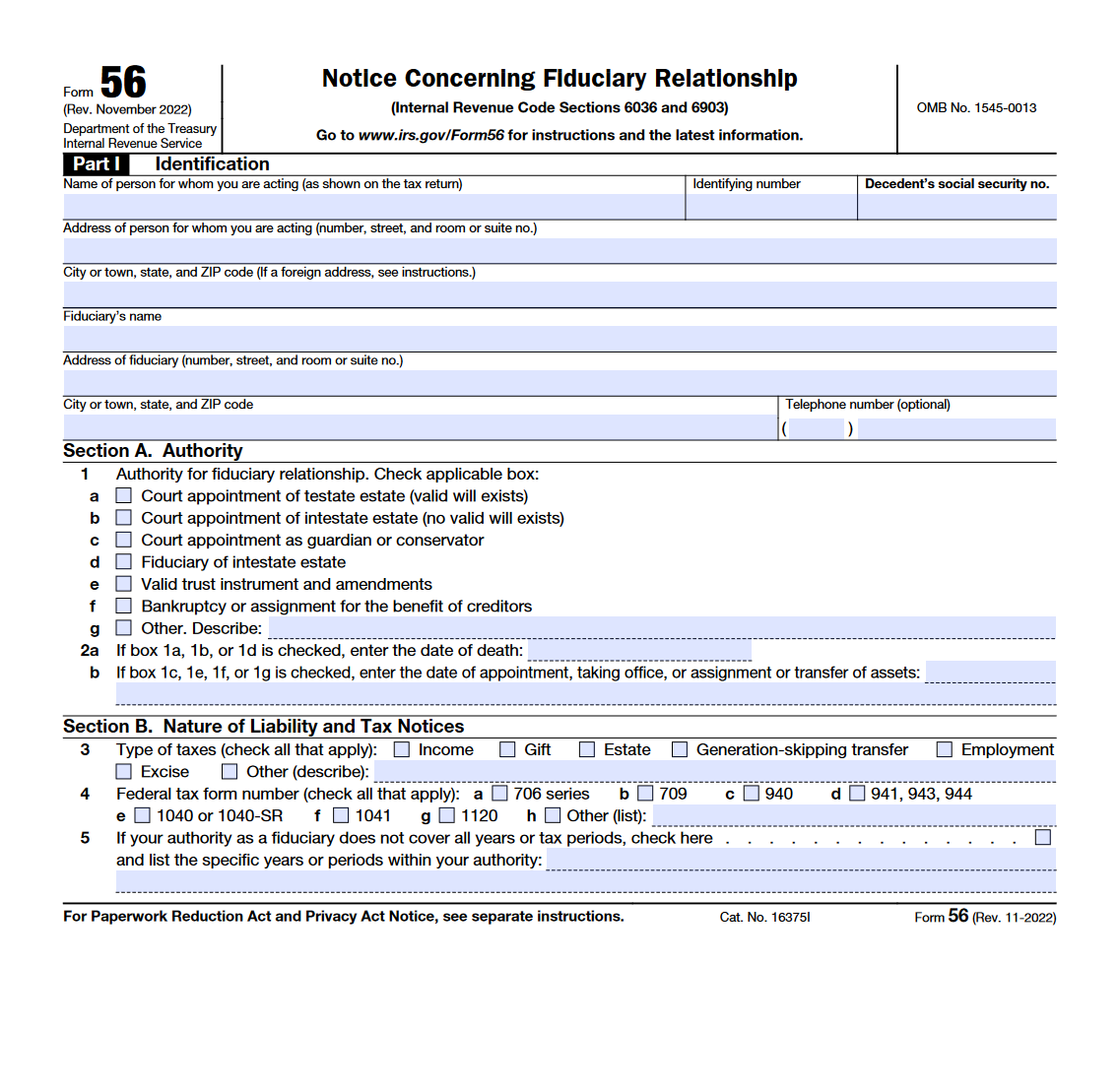

IRS Form 56. Notice Concerning Fiduciary Relationship Forms Docs 2023

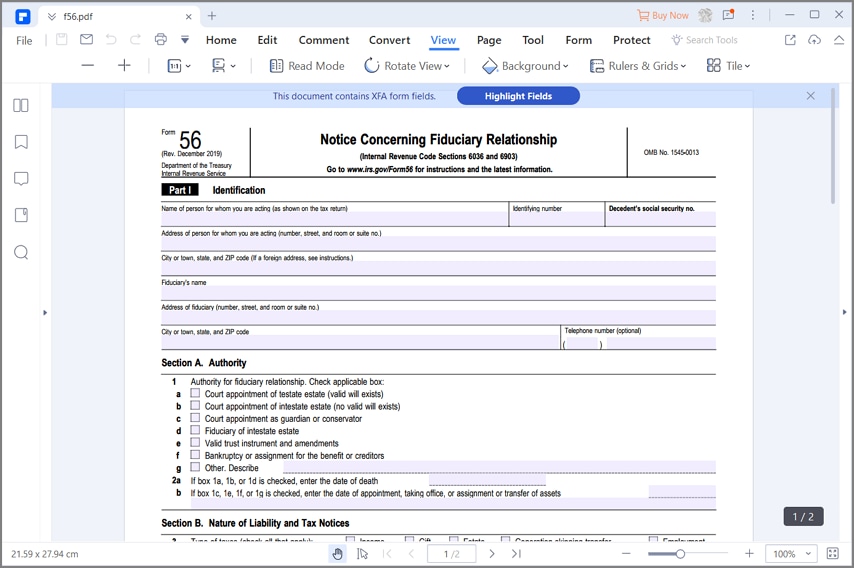

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a.

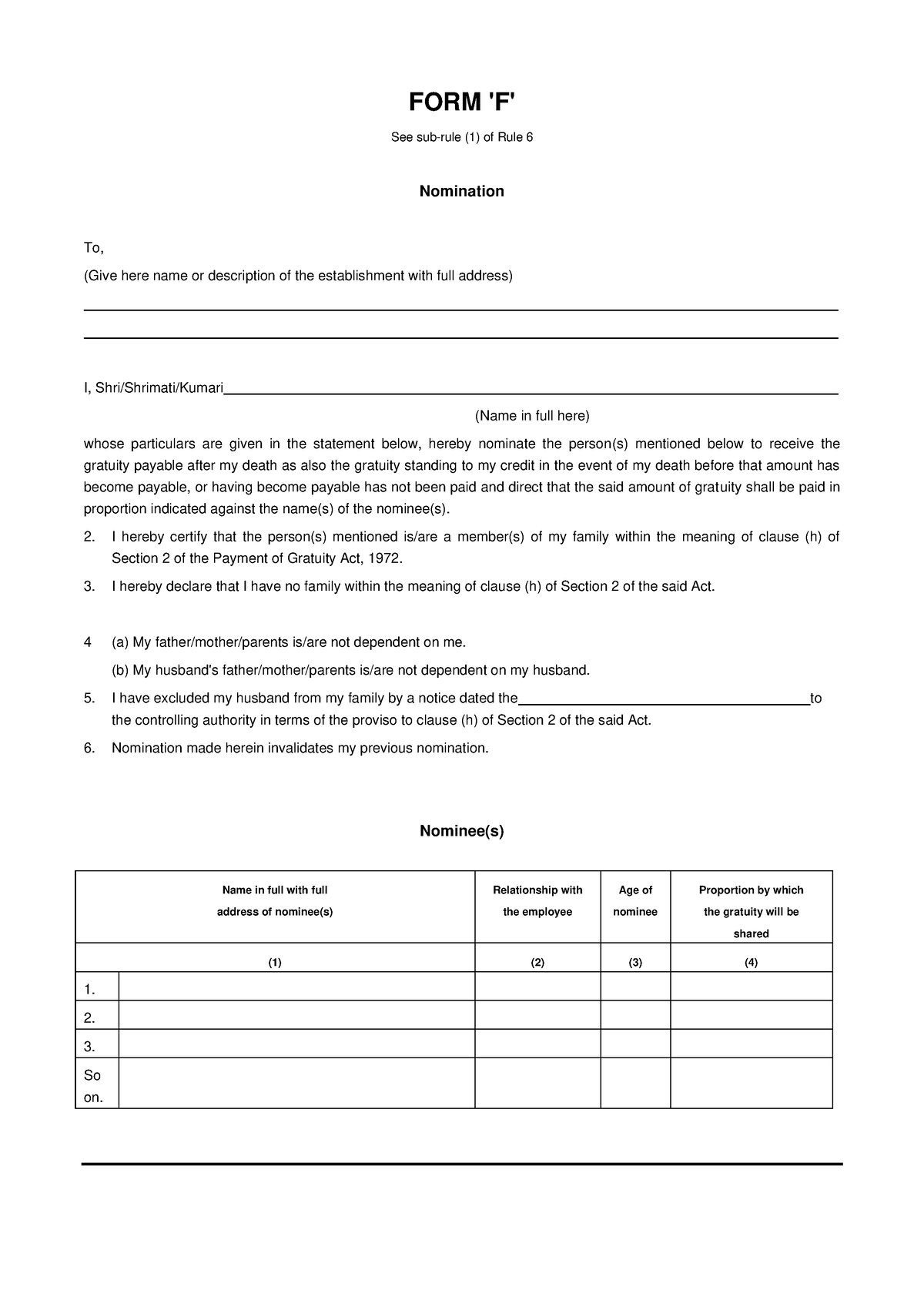

Form F FORM 'F' See subrule (1) of Rule 6 Nomination To, (Give here

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary.

IRS Form 56F Instructions Fiduciary of a Financial Institution

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial.

Form 56 Fillable Pd Printable Forms Free Online

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary.

Form 561

Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. The form must also be filed in every subsequent tax year that the. Use this form to notify the irs of.

A Look at the IR56F Form in Hong Kong HKWJ Tax Law

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary.

Svalk børstetætningsliste Fform 2114 mm 3 m

The form must also be filed in every subsequent tax year that the. Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary concerning the person for whom he/she is acting. Use this form to notify the irs of.

IRS Form 56 YOU appoints You as Fiduciary over the SSN Account YouTube

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to inform the irs that a person in acting for another person in a fiduciary capacity so that the irs may mail tax notices to the fiduciary.

Form 56 Is Used To Inform The Irs That A Person In Acting For Another Person In A Fiduciary Capacity So That The Irs May Mail Tax Notices To The Fiduciary Concerning The Person For Whom He/She Is Acting.

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). The form must also be filed in every subsequent tax year that the.