28 Percent Rate Gain Worksheet - Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out the tax rates,. Deferral of gain invested in a qualified opportunity fund (qof). Find out when to use form 8949,.

Find out when to use form 8949,. Find out the tax rates,. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts.

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out the tax rates,. Deferral of gain invested in a qualified opportunity fund (qof). Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero);

You Can Apply Several Different Worksheet Themes From Which Tab

Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out when to use form 8949,. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report capital gains and.

10++ 28 Rate Gain Worksheet Worksheets Decoomo

Deferral of gain invested in a qualified opportunity fund (qof). Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. Find.

Fillable Online 28 Rate Gain Worksheet Line 18 Fax Email Print

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out when to use form 8949,. Find out the tax rates,.

28 Percent Rate Gain Worksheet

Find out the tax rates,. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out when to use form 8949,.

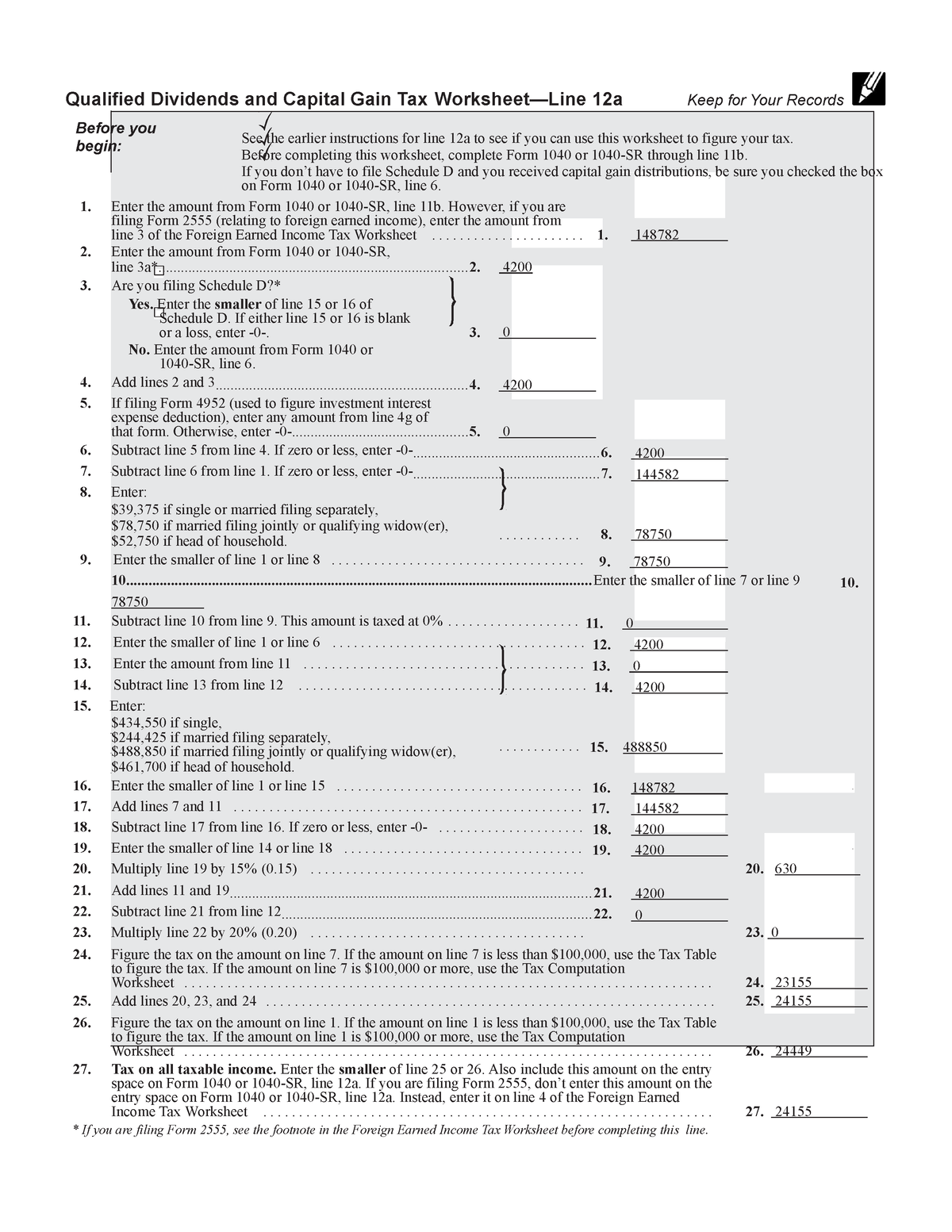

Qualified Dividend And Capital Gain Tax

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than.

28 Rate Gain Worksheet 2023

Deferral of gain invested in a qualified opportunity fund (qof). Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report.

28 Percent Rate Gain Worksheet 2023

Find out when to use form 8949,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Enter the total of all collectibles gain.

28 Rate Gain Worksheet Instructions

Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and.

Printable Worksheets

Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Deferral of gain invested in a qualified opportunity fund (qof). Find out the tax rates,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Learn.

Builtin Gains Tax Calculation Worksheet

Deferral of gain invested in a qualified opportunity fund (qof). Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out when to use form 8949,. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn.

Find Out The Tax Rates,.

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Deferral of gain invested in a qualified opportunity fund (qof). Find out when to use form 8949,.