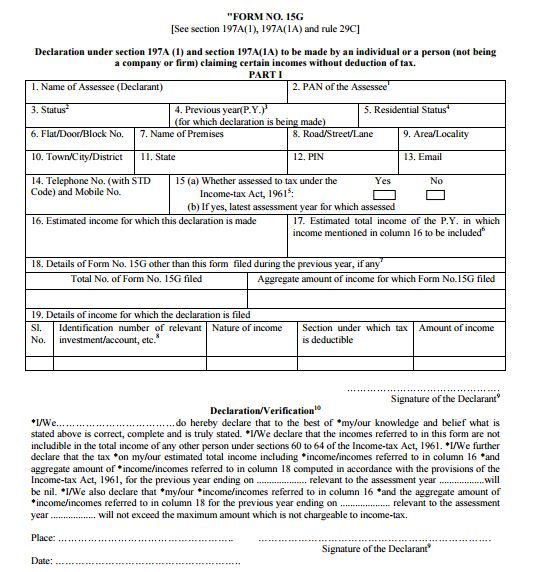

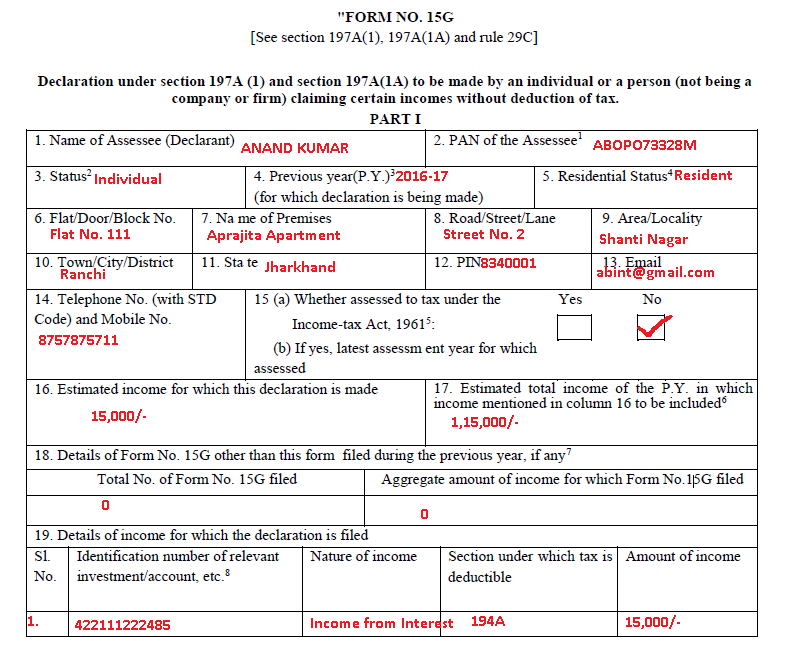

15G Or 15H Form - These forms are used to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.

Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to.

These forms are used to. Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

Download Form 15G for PF Withdrawal 2022

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to. Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.

Form 15G and Form 15H Save TDS on Interest

Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to.

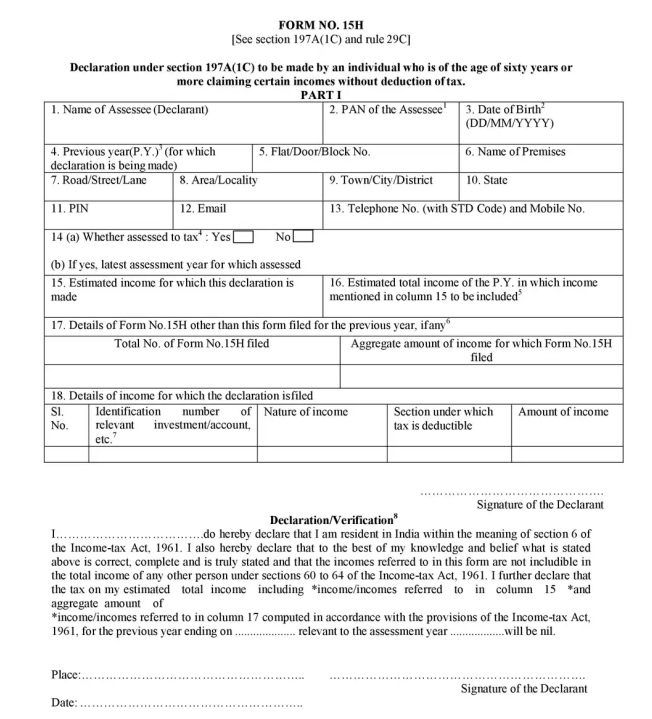

Sample Filled Form 15G & 15H for PF Withdrawal in 2021 Form

These forms are used to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.

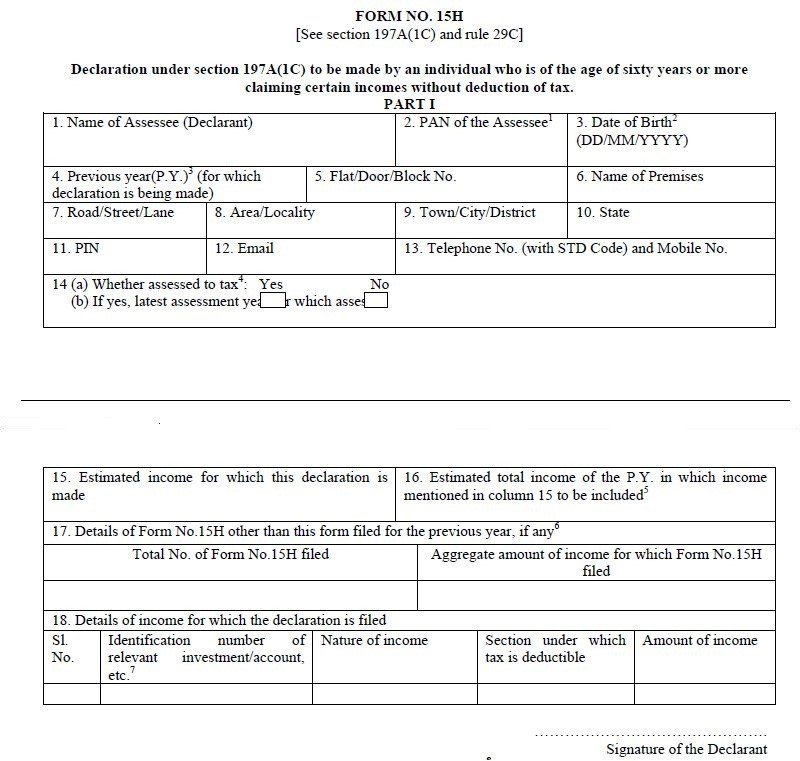

Form 15G and Form 15H Save TDS on Interest

Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. These forms are used to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

How To Fill New Form 15G / Form 15H roy's Finance

These forms are used to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.

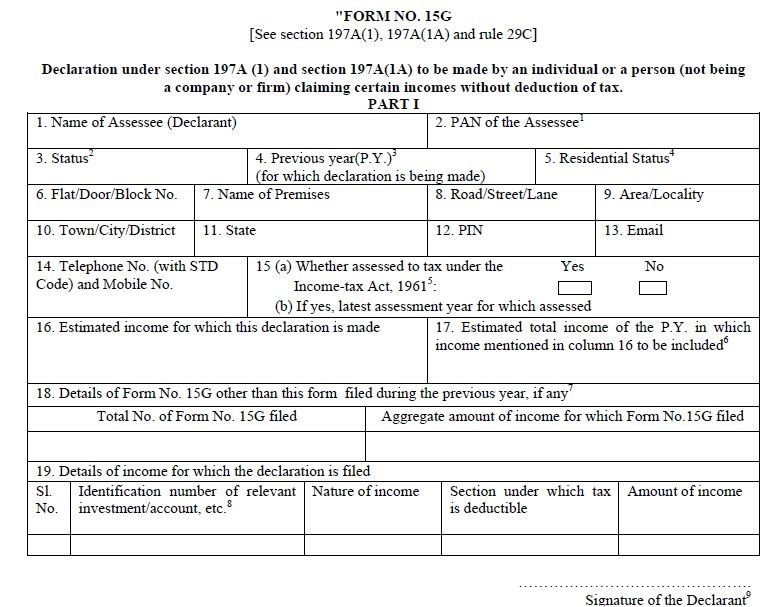

Know Who should file Form 15G and Form 15H? TaxHelpdesk

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to. Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.

Form 15g Fillable Complete with ease airSlate SignNow

These forms are used to. Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. These forms are used to.

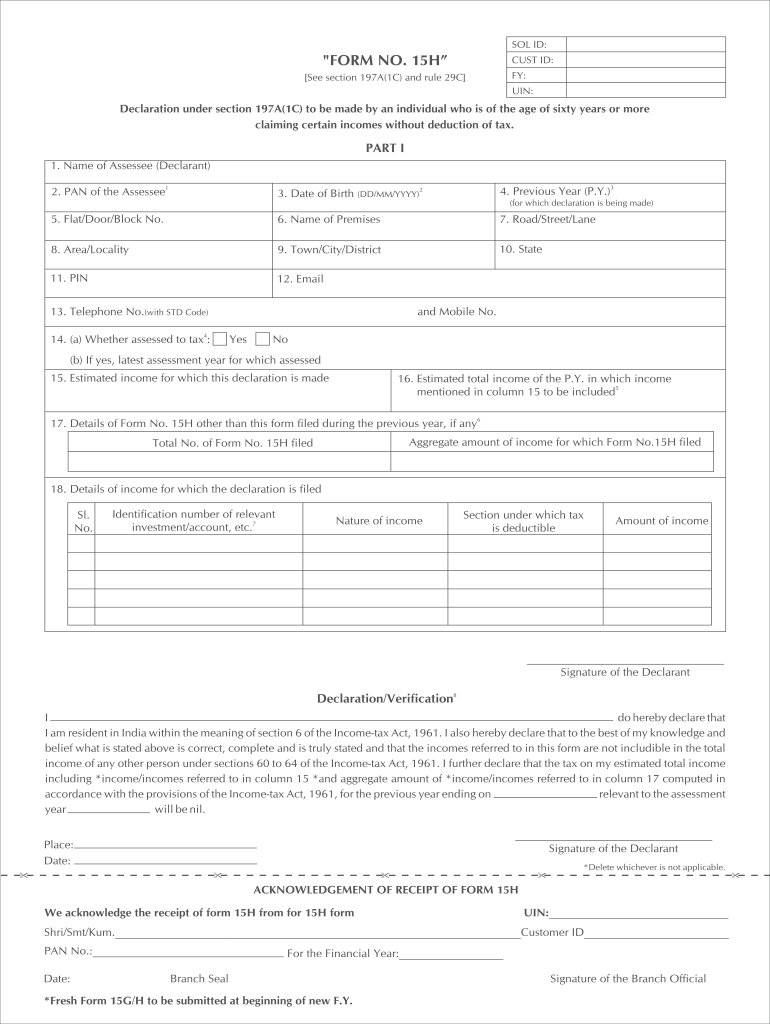

Form 15G & 15H Save TDS on Interest Tax2win

Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to.

How To Fill New Form 15G / Form 15H ROYS FINANCE

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to. Forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.

Forms 15G And 15H Are Declaration Forms That Can Help You Prevent Tds On Your Fixed Deposit Interest Income.

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). These forms are used to.